The stock market has always been a place where predictions and speculation reign supreme. As we navigate through the first few months of 2024, investors are keen on understanding where the US stock market is headed. This article delves into the current market predictions and provides insights into the trends shaping the US stock market for the year 2024 to date.

Economic Growth and Interest Rates

One of the primary factors influencing the US stock market is economic growth. Experts have varying opinions on the pace of economic expansion for 2024. While some predict moderate growth, others anticipate a slowdown due to factors like inflation and supply chain disruptions. This uncertainty has led to cautious optimism among investors.

The Federal Reserve's interest rate decisions also play a crucial role in shaping the stock market. The Fed has been gradually raising interest rates to combat inflation, and these moves have had a direct impact on stock prices. Many experts believe that higher interest rates will continue to put pressure on the stock market in the short term, but long-term investors are hopeful for a sustainable recovery.

Sector Performances

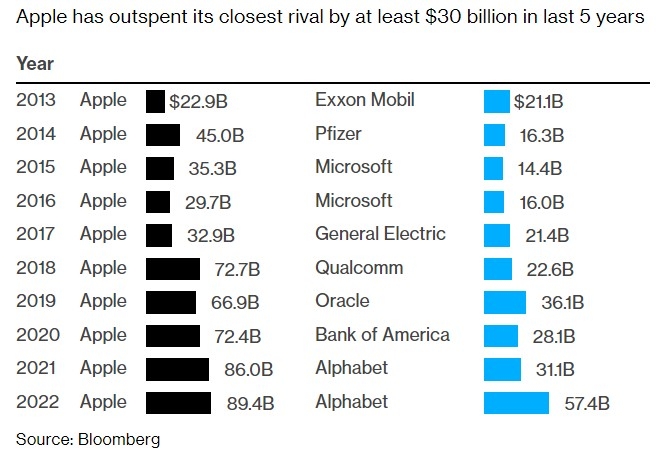

Several sectors have been performing well in the US stock market so far in 2024. The technology sector, which has been a significant driver of growth over the past decade, continues to attract investors. Companies like Apple, Microsoft, and Google have shown resilience amidst economic uncertainty.

On the other hand, sectors like energy and financials have faced challenges. The energy sector has been impacted by geopolitical tensions and supply disruptions, while the financial sector is under pressure due to higher interest rates and increased regulatory scrutiny. Despite these challenges, some experts believe that these sectors will bounce back in the second half of 2024.

Market Trends

Several key trends have been shaping the US stock market so far in 2024:

- Dividend Stocks: Investors have been turning to dividend stocks for stability and income generation. Companies with strong balance sheets and steady cash flows are seeing increased demand.

- E-commerce: The rise of e-commerce has been a significant trend in the stock market. Companies like Amazon and eBay have continued to grow, driven by increased online shopping.

- Sustainability: Sustainability and ESG (Environmental, Social, and Governance) factors are becoming increasingly important in the investment landscape. Companies that prioritize sustainability are attracting more investors.

Case Studies

One notable example is Tesla, a company that has revolutionized the automotive industry. Despite facing challenges like supply chain disruptions and increased competition, Tesla has managed to maintain its position as a market leader. This resilience has attracted investors who believe in the company's long-term potential.

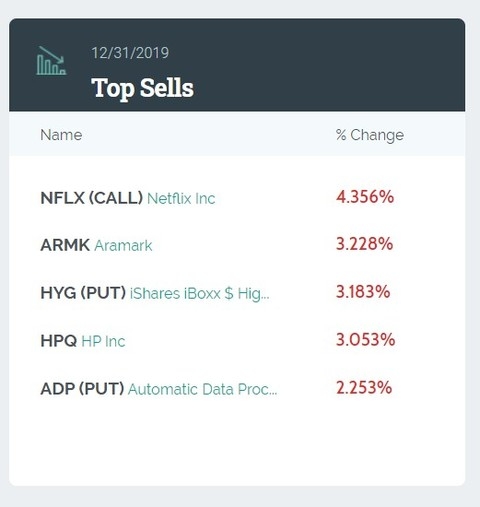

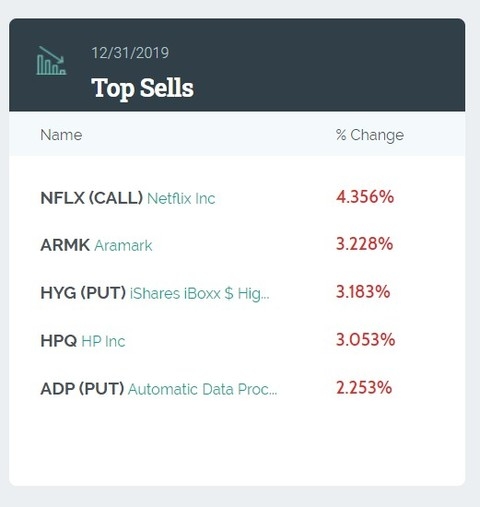

Another example is Netflix, a streaming giant that has been able to navigate the challenges of the pandemic and continue to grow its subscriber base. Netflix's focus on original content and global expansion has made it a favorite among investors.

Conclusion

As we move further into 2024, the US stock market continues to face uncertainty. However, with a mix of economic growth, sector performances, and emerging trends, investors are hopeful for a robust market. It's crucial to stay informed and make well-informed investment decisions to navigate the evolving landscape of the US stock market.