In the vast landscape of the global financial market, local stock exchanges play a pivotal role in shaping the economic vitality and stability of countries worldwide. For the United States, this is no different. The local stock exchanges in the U.S. serve as gateways for investors, both institutional and individual, to participate in the nation's robust stock market. This article delves into the significance of local stock exchanges in the U.S., highlighting their impact on the economy and the opportunities they present to investors.

The Role of Local Stock Exchanges

Local stock exchanges provide a platform for companies to raise capital by selling shares to the public. This process, known as an initial public offering (IPO), is crucial for the growth and expansion of businesses. In the U.S., the most prominent local stock exchanges are the New York Stock Exchange (NYSE) and the NASDAQ, which together account for a significant portion of the global market capitalization.

The New York Stock Exchange (NYSE)

Established in 1792, the NYSE is the oldest and largest stock exchange in the U.S. It is renowned for listing some of the most iconic companies in the world, including Apple, Microsoft, and General Electric. The NYSE operates on an auction-style trading system, where buyers and sellers gather in a physical trading floor to execute trades.

The NASDAQ Stock Market

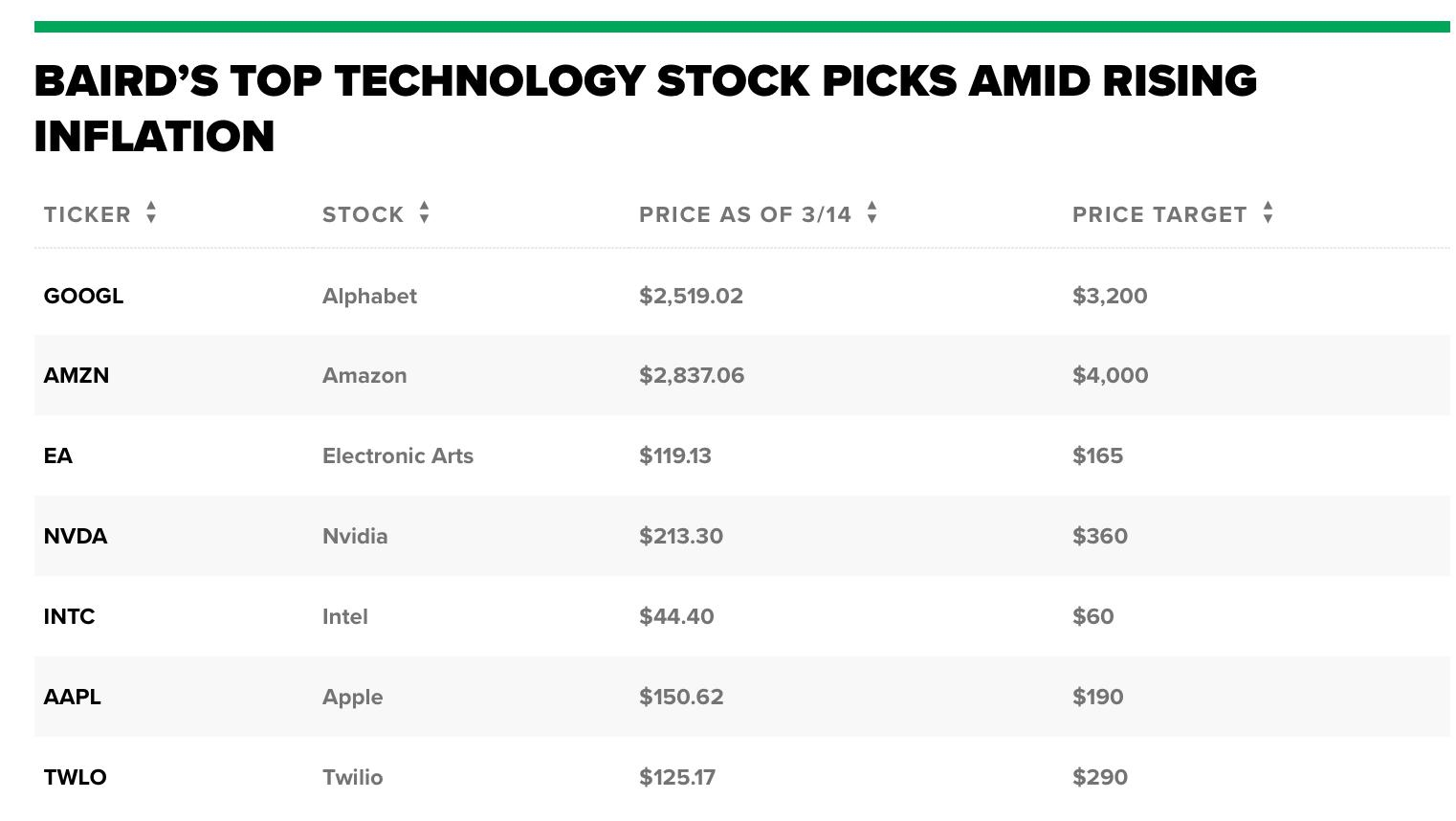

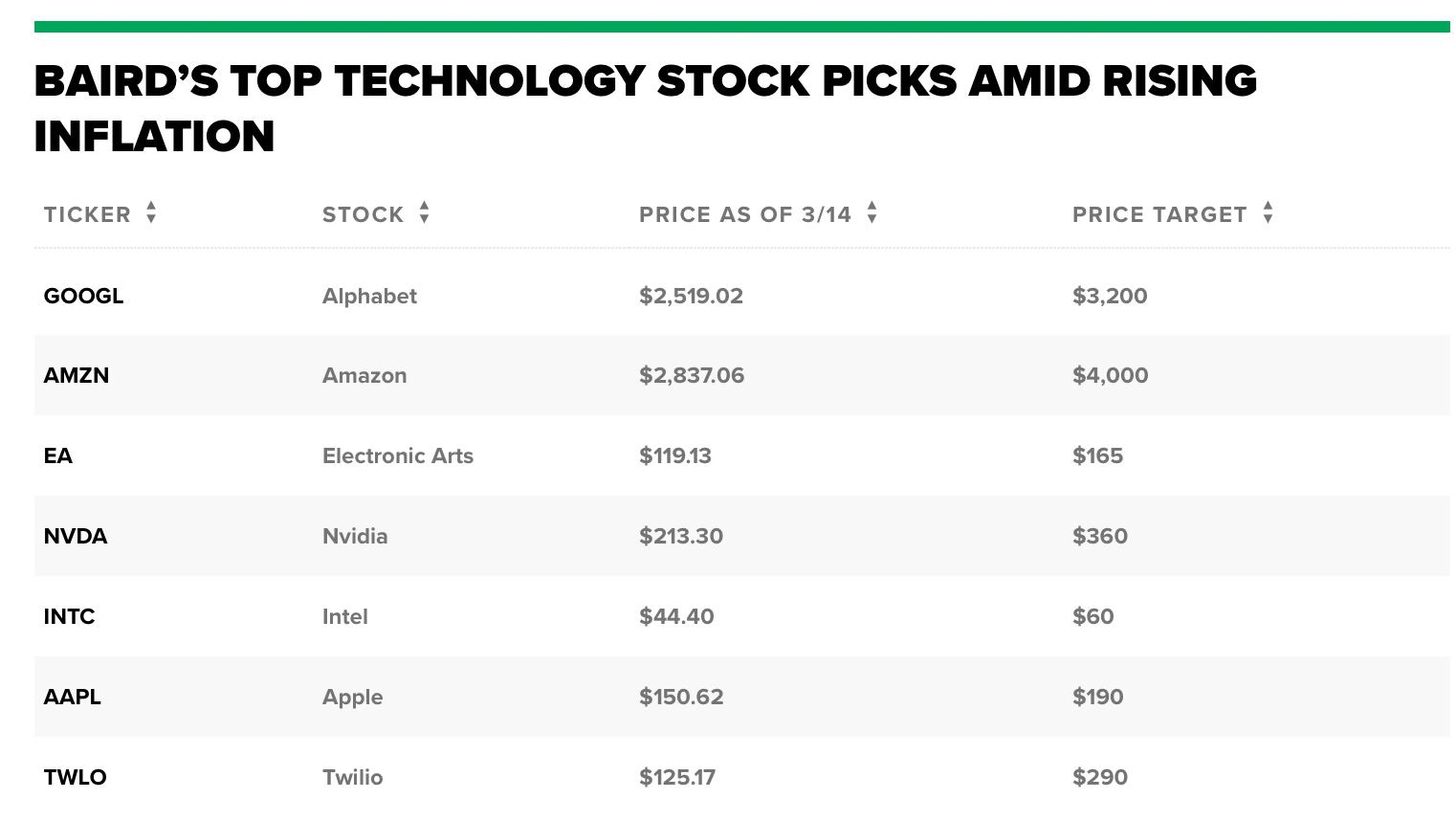

Launched in 1971, the NASDAQ is the first electronic stock market and the second-largest stock exchange in the U.S. It is known for listing technology companies, with giants like Amazon, Google, and Apple trading on its platform. The NASDAQ operates on an electronic trading system, providing liquidity and efficiency to its investors.

Opportunities for Investors

Investing in local stock exchanges offers numerous opportunities for investors. For instance, the NYSE and NASDAQ provide exposure to a wide range of sectors, from technology and healthcare to consumer goods and energy. This diversity allows investors to construct a diversified portfolio that aligns with their investment goals and risk tolerance.

Case Study: Tesla, Inc.

A prime example of a company benefiting from a local stock exchange is Tesla, Inc. After its IPO in 2010, Tesla listed on the NASDAQ under the symbol TSLA. Since then, the company has experienced exponential growth, with its stock price soaring from around

Challenges and Risks

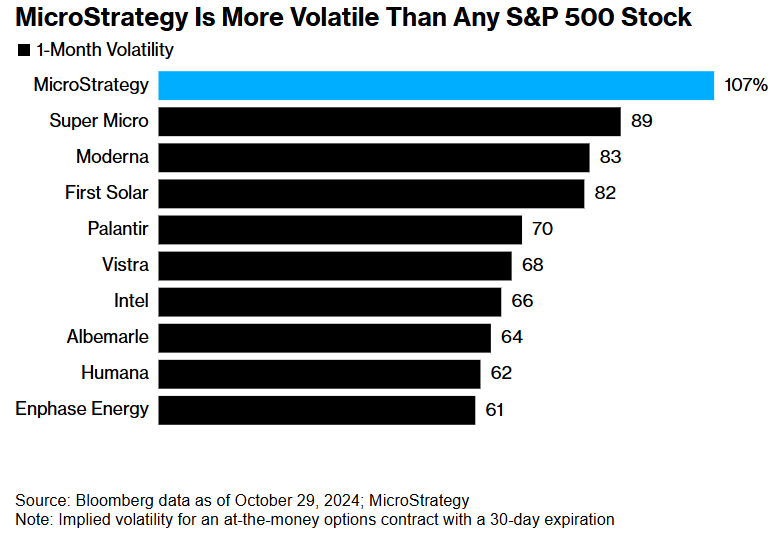

While investing in local stock exchanges presents opportunities, it also comes with its fair share of challenges and risks. Market volatility, regulatory changes, and economic uncertainties are some of the factors that can impact the performance of stocks. Therefore, it is essential for investors to conduct thorough research and seek professional advice before making investment decisions.

Conclusion

Local stock exchanges in the U.S. are vital components of the nation's economic ecosystem. They provide opportunities for companies to raise capital and investors to grow their wealth. By understanding the nuances of these exchanges, investors can make informed decisions and potentially capitalize on the market's growth potential.