Introduction:

When it comes to investing, one of the most common questions investors face is whether it's risky to buy only US stocks. With the vast array of options available, it's crucial to weigh the potential benefits against the risks involved. In this article, we'll delve into the various aspects of investing solely in US stocks and explore the potential risks and rewards.

Understanding the US Stock Market:

The US stock market is one of the largest and most liquid markets in the world, offering investors a wide range of opportunities. It's home to numerous global giants, such as Apple, Microsoft, and Amazon, and has a reputation for being a stable and profitable investment destination.

Benefits of Investing in US Stocks:

- Diversification: The US stock market offers a diverse range of sectors and industries, allowing investors to diversify their portfolios and reduce risk.

- High Growth Potential: Many US companies have the potential for significant growth, especially in emerging sectors like technology and healthcare.

- Strong Regulatory Environment: The US has stringent regulations that protect investors and ensure fair and transparent trading practices.

Risks of Investing in US Stocks:

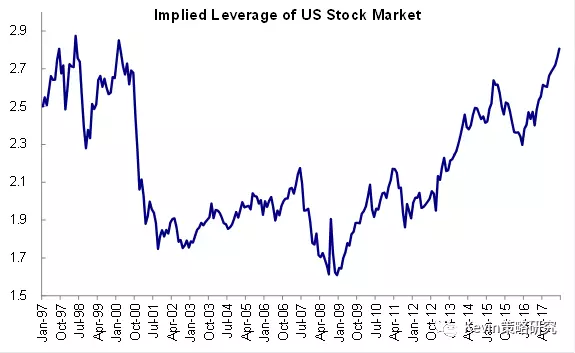

- Economic Volatility: The US economy can be unpredictable, with periods of economic growth followed by downturns. This volatility can impact the performance of stocks.

- Political Risk: Political events, such as elections or policy changes, can create uncertainty and affect the stock market.

- Market Saturation: Some sectors in the US market, like technology, may be overvalued due to intense competition and saturation.

Diversification: The Key to Risk Management:

To mitigate the risks associated with investing solely in US stocks, many investors choose to diversify their portfolios. This involves allocating investments across different asset classes, sectors, and geographic regions. Diversification can help reduce the impact of economic or market-specific events.

Case Studies:

- Tech Bubble of 2000: The tech bubble in the early 2000s resulted in a significant drop in tech stock prices. Investors who had diversified their portfolios outside of the tech sector were better able to weather the storm.

- Global Financial Crisis of 2008: During the financial crisis, the US stock market experienced a severe downturn. Investors with well-diversified portfolios, including international stocks, were better protected from the losses.

Conclusion:

While investing solely in US stocks can offer numerous benefits, it also comes with its share of risks. By understanding these risks and considering diversification, investors can make more informed decisions. Remember, it's essential to do thorough research and consult with a financial advisor before making any investment decisions.

Keywords: US stock market, investment risks, diversification, stock market volatility, tech bubble, global financial crisis