The Consumer Price Index (CPI), a key economic indicator, plays a pivotal role in shaping the stock market's landscape. As investors closely monitor the CPI, its fluctuations can significantly impact stock prices and market trends. In this article, we delve into the impact of the US CPI on the stock market, exploring its role, significance, and potential implications.

Understanding the CPI

The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It reflects the inflation rate and serves as a gauge of purchasing power. When the CPI rises, it indicates inflation, whereas a decrease suggests deflation.

Impact on Stock Market

The US CPI has a profound impact on the stock market in several ways:

1. Valuation Adjustments:

- Inflation: When the CPI rises, it can lead to higher corporate costs, impacting earnings. This often results in downward adjustments to stock valuations, as investors reassess the future earning potential of companies.

- Deflation: Conversely, if the CPI falls, it may indicate weaker demand and lower corporate earnings. This can lead to downward pressure on stock prices.

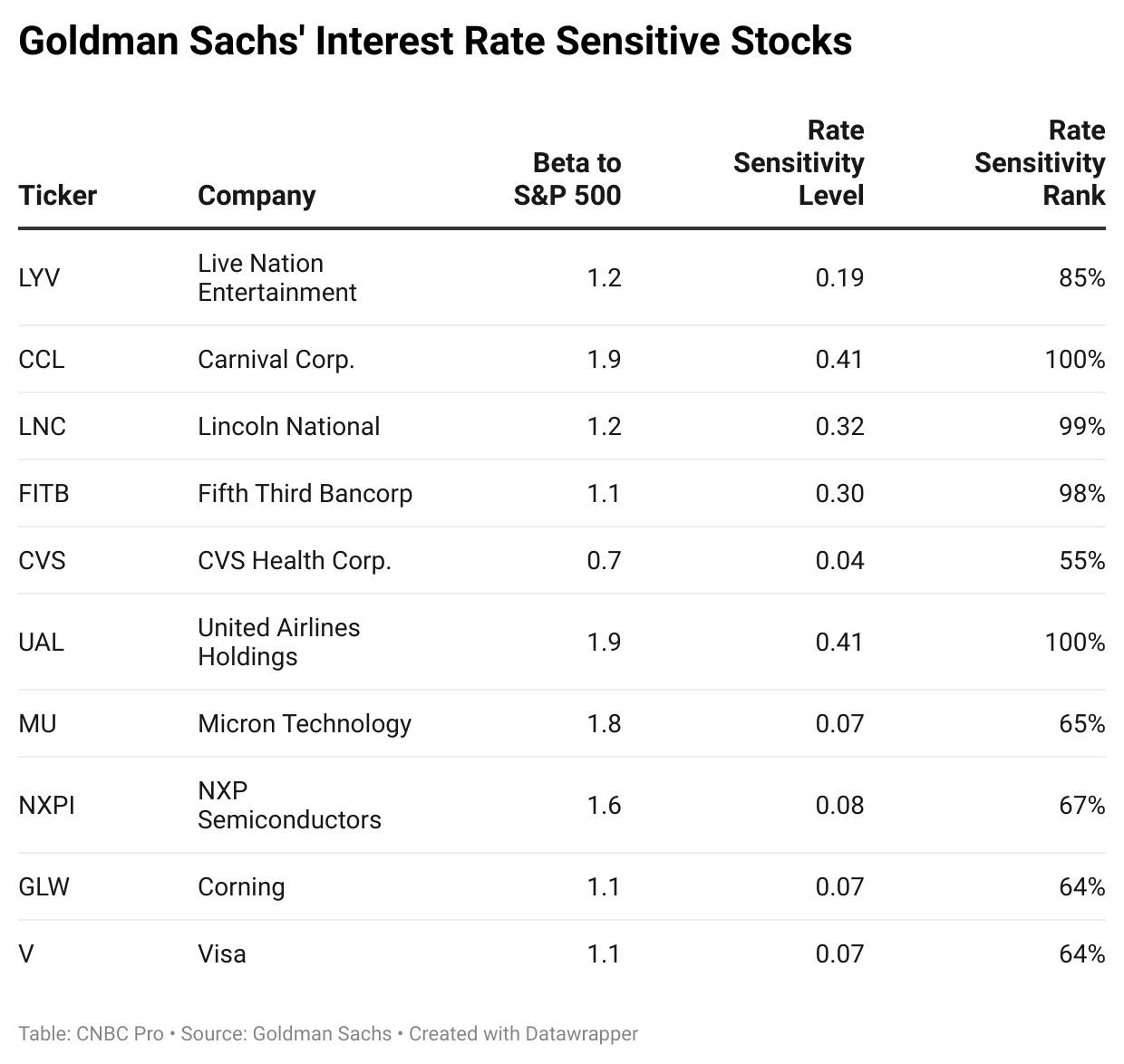

2. Interest Rate Expectations:

The CPI is a crucial factor in determining interest rates set by the Federal Reserve. Higher inflation often leads to higher interest rates, which can negatively impact stock prices. Conversely, lower inflation may lead to lower interest rates, potentially boosting stock market performance.

3. Consumer Spending:

The CPI influences consumer spending patterns. When the CPI rises, consumers may cut back on discretionary spending, impacting companies in sectors like retail and consumer goods. This can lead to lower earnings and stock prices.

4. Sector-Specific Implications:

Different sectors respond differently to changes in the CPI. For instance:

- Energy Sector: Higher CPI often leads to higher energy prices, benefiting energy companies.

- Real Estate Sector: Rising CPI can lead to higher property values, benefiting real estate companies.

- Consumer Discretionary Sector: Higher CPI can lead to lower consumer spending, negatively impacting companies in this sector.

Case Study: The 2020 COVID-19 Pandemic

The COVID-19 pandemic in 2020 had a significant impact on the US CPI and the stock market. As the pandemic spread, the CPI fell sharply due to lower energy prices and reduced consumer spending. However, the stock market initially surged due to expectations of economic stimulus and lower interest rates. As the situation evolved, the relationship between the CPI and the stock market became more complex, highlighting the dynamic nature of this relationship.

Conclusion

The US CPI is a critical economic indicator that has a profound impact on the stock market. Its fluctuations can influence stock valuations, interest rate expectations, consumer spending, and sector-specific performance. Understanding the relationship between the CPI and the stock market is crucial for investors to make informed decisions and navigate the ever-changing market landscape.