Introduction

Investing in US stocks can be a rewarding venture, offering the potential for significant returns. However, it requires knowledge, research, and a well-thought-out strategy. This guide will walk you through the essential steps to help you invest in US stocks successfully.

1. Understand the Basics

Before diving into the market, it's crucial to understand the basics of stock investing. A stock represents a share of ownership in a company. When you buy a stock, you become a shareholder and have a claim on the company's assets and earnings.

2. Define Your Investment Goals

Before investing, it's essential to define your investment goals. Are you looking for long-term growth, income, or both? Your goals will determine the type of stocks you should consider.

3. Research and Analyze

Research is key to successful stock investing. Analyze the financial health of the companies you're interested in. Look at their income statements, balance sheets, and cash flow statements. Additionally, consider the industry trends and the company's competitive position.

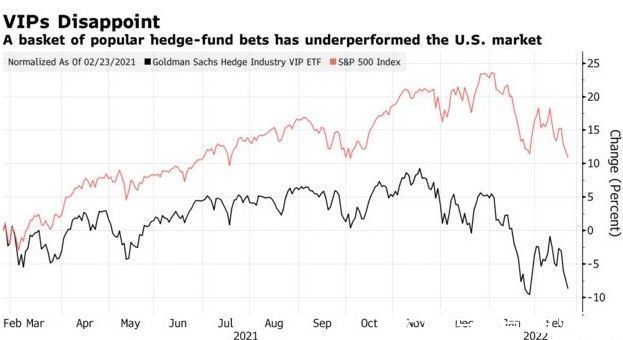

4. Diversify Your Portfolio

Diversification is crucial to mitigate risk. Don't put all your eggs in one basket. Invest in different sectors, industries, and geographical regions. This approach helps protect your portfolio from the volatility of individual stocks.

5. Choose a Brokerage Account

To invest in US stocks, you'll need a brokerage account. There are many brokerage firms to choose from, each offering different services and fees. Consider factors like fees, ease of use, and customer service when choosing a brokerage.

6. Understand Order Types

When placing orders to buy or sell stocks, you need to understand the different types of orders available. The most common types include market orders, limit orders, and stop orders. Each type has its advantages and disadvantages, so choose the one that best suits your investment strategy.

7. Start Small and Scale Up

If you're new to investing, start small and gradually increase your investment as you gain more confidence and experience. This approach allows you to learn from your mistakes without risking a significant amount of capital.

8. Monitor Your Investments

Once you've invested in stocks, it's essential to monitor their performance. Keep an eye on the news, financial reports, and market trends. This will help you make informed decisions and adjust your strategy as needed.

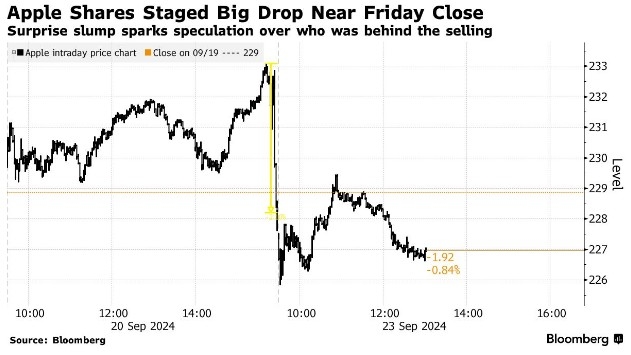

Case Study: Apple Inc.

A prime example of a successful investment in US stocks is Apple Inc. (AAPL). When Apple went public in 1980, the stock price was $22. Over the years, the company has grown significantly, and the stock price has soared. By investing in Apple early on and holding onto the stock, investors have seen substantial returns.

Conclusion

Investing in US stocks can be a lucrative endeavor, but it requires careful planning and execution. By understanding the basics, conducting thorough research, diversifying your portfolio, and monitoring your investments, you can increase your chances of success. Remember, patience and discipline are key to long-term investing success.