Investing in US stocks from India can be a lucrative opportunity for investors looking to diversify their portfolios and capitalize on the robust American economy. With the rise of digital platforms and advancements in technology, investing in US stocks has become more accessible than ever. This article will guide you through the process of investing in US stocks from India, highlighting key considerations and strategies to help you make informed decisions.

Understanding the Basics

Before diving into the investment process, it's crucial to understand the basics of investing in US stocks. The United States is home to some of the world's largest and most successful companies, offering a wide range of investment opportunities across various sectors. Whether you're interested in technology, healthcare, finance, or consumer goods, the US stock market has something to offer.

Choosing a Brokerage

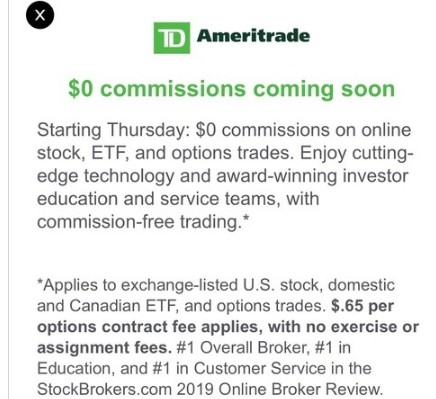

The first step in investing in US stocks from India is to choose a reliable brokerage firm. Several reputable brokers offer services that allow Indian investors to trade US stocks. When selecting a brokerage, consider factors such as fees, customer support, platform features, and regulatory compliance. Some popular brokerage options for Indian investors include:

- E*TRADE: Known for its user-friendly platform and extensive research tools, E*TRADE is a popular choice among investors.

- Fidelity: Fidelity offers competitive fees and a wide range of investment options, making it an excellent choice for both beginners and experienced investors.

- Charles Schwab: Schwab is renowned for its comprehensive research and educational resources, making it a great choice for investors looking to expand their knowledge.

Opening an Account

Once you've chosen a brokerage, the next step is to open an account. The process typically involves filling out an application form, providing personal and financial information, and verifying your identity. Some brokers may require additional documentation, such as proof of address or bank statements.

Understanding Risk and Reward

Investing in US stocks from India comes with both risks and rewards. While the US stock market has historically offered higher returns than the Indian market, it's essential to understand the potential risks involved. These include market volatility, currency exchange rates, and political and economic uncertainties.

Investment Strategies

There are several investment strategies you can consider when investing in US stocks from India:

- Diversification: Diversifying your portfolio across different sectors and geographic regions can help mitigate risk.

- Value Investing: Investing in companies that are undervalued relative to their intrinsic value can lead to significant returns over the long term.

- Growth Investing: Investing in companies with high growth potential can offer substantial returns, but it also comes with higher risk.

Case Study: Reliance Industries Ltd.

To illustrate the potential benefits of investing in US stocks from India, let's consider the case of Reliance Industries Ltd. (RIL). RIL is one of India's largest companies, with a diverse portfolio of businesses across energy, retail, and telecommunications. By investing in RIL, Indian investors can gain exposure to the Indian market while also benefiting from the company's global operations.

Conclusion

Investing in US stocks from India can be a rewarding opportunity for investors looking to diversify their portfolios and capitalize on the global market. By understanding the basics, choosing a reliable brokerage, and adopting a well-thought-out investment strategy, you can make informed decisions and potentially achieve significant returns.