In the ever-evolving world of investing, diversification is a key strategy to manage risk and maximize returns. One of the most popular ways to diversify a portfolio is by including U.S. stocks. But how exactly can U.S. stocks help in diversifying your portfolio? Let's dive into this topic and explore the benefits of adding U.S. stocks to your investment strategy.

Understanding Diversification

Diversification is the practice of spreading your investments across various asset classes, sectors, and geographic regions to reduce risk. By doing so, you can protect your portfolio from the volatility of any single investment. The goal is to ensure that if one asset performs poorly, others will likely perform well, balancing out the overall risk and return profile of your portfolio.

Why U.S. Stocks?

The U.S. stock market is one of the largest and most liquid in the world, offering a wide range of investment opportunities. Here are some reasons why U.S. stocks can be a valuable addition to your diversified portfolio:

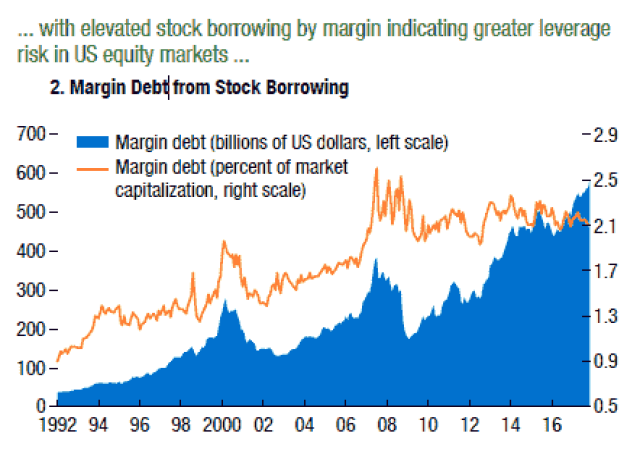

Market Size and Liquidity: The U.S. stock market is home to many of the world's largest and most well-known companies. This market's liquidity allows for easy buying and selling of stocks, ensuring that investors can enter and exit positions without significantly impacting the price.

Economic Stability: The U.S. has a stable economy and political system, which can provide a more predictable environment for businesses to operate and grow. This stability can lead to more consistent returns over the long term.

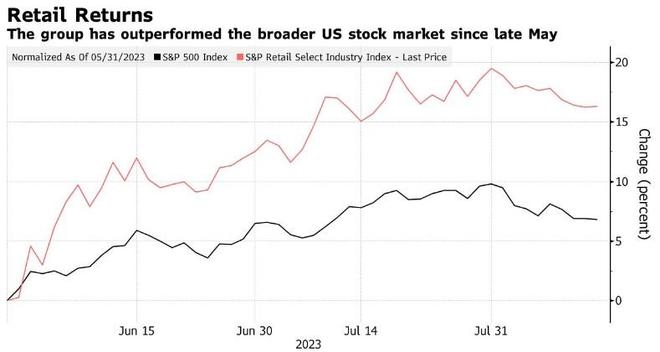

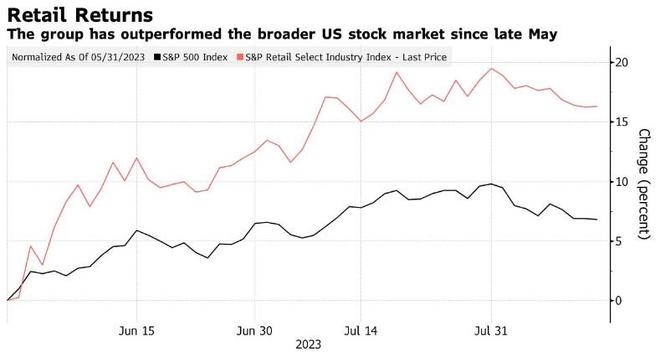

Innovation and Growth: The U.S. is a hub for innovation, with many companies leading in technology, healthcare, and consumer goods. Investing in U.S. stocks can provide exposure to these high-growth sectors.

Adding U.S. Stocks to Your Portfolio

To diversify your portfolio with U.S. stocks, consider the following steps:

Identify Your Investment Goals: Determine your financial goals, risk tolerance, and investment horizon. This will help you choose the right mix of U.S. stocks for your portfolio.

Research and Select Stocks: Conduct thorough research on companies you're interested in, including their financial health, growth prospects, and market position. Look for companies with strong fundamentals and a solid track record.

Diversify Across Sectors: Include stocks from various sectors, such as technology, healthcare, finance, and consumer goods. This will help spread out your risk and potentially benefit from different market cycles.

Consider Index Funds or ETFs: To simplify the process, you can invest in index funds or exchange-traded funds (ETFs) that track a specific index, such as the S&P 500. This allows you to gain exposure to a broad range of U.S. stocks without having to select individual companies.

Monitor and Rebalance: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalance as needed to maintain the desired level of diversification.

Case Study: Apple Inc.

A prime example of a U.S. stock that has proven to be a valuable addition to a diversified portfolio is Apple Inc. (AAPL). Since its initial public offering in 1980, Apple has become one of the world's most valuable companies, with a market capitalization of over $2 trillion. Its products, such as the iPhone, iPad, and Mac, have become household names, driving significant revenue and profits.

By including Apple in a diversified portfolio, investors have benefited from its consistent growth and stability. However, it's important to note that while Apple has performed well, it's also experienced periods of volatility, which is why diversification is crucial.

In conclusion, U.S. stocks can be a valuable component of a diversified portfolio, offering exposure to a wide range of industries and sectors. By carefully selecting stocks and maintaining a well-diversified portfolio, investors can manage risk and potentially achieve long-term growth.