Are you an Australian investor looking to diversify your portfolio with US tech stocks? The United States is home to some of the world's most successful and innovative tech companies. From giants like Apple and Google to emerging startups, there are numerous opportunities to profit from the tech sector. In this article, we'll explore the steps Australian investors can take to buy US tech stocks and maximize their investment potential.

Understanding the Basics

Before diving into the details, it's important to understand the basics of investing in US stocks from Australia. The Australian dollar and the US dollar operate independently, so currency exchange rates will play a significant role in your investment strategy. Additionally, you'll need to consider the differences in trading hours, regulations, and tax implications.

Opening a Brokerage Account

The first step in buying US tech stocks is to open a brokerage account. A brokerage account allows you to buy and sell stocks, bonds, and other securities. There are several brokerage firms that cater specifically to Australian investors, such as eTrade, Interactive Brokers, and Fidelity.

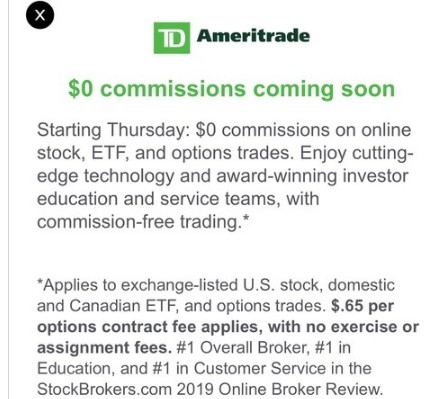

When choosing a brokerage firm, consider factors such as fees, customer service, and platform features. Many brokers offer commissions-free trading on certain stocks, which can help reduce costs.

Understanding Currency Exchange

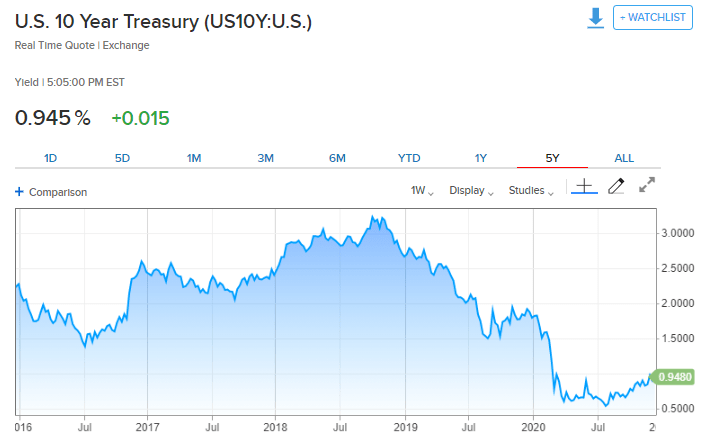

As mentioned earlier, currency exchange rates will impact your investment returns. When you buy US tech stocks, you'll be exchanging Australian dollars for US dollars. This exchange rate fluctuates constantly, so it's important to stay informed about the latest developments.

One way to mitigate the impact of currency exchange rates is to use a currency forward contract. This allows you to lock in an exchange rate for a future date, helping to protect your investment from currency fluctuations.

Researching US Tech Stocks

Once you have a brokerage account, it's time to start researching US tech stocks. Look for companies with strong fundamentals, such as a robust financial position, positive revenue growth, and a dedicated customer base.

Some popular US tech stocks to consider include:

- Apple: A leader in the smartphone and computer market, with a diverse product line and a loyal customer base.

- Google: A dominant player in the search engine and advertising industry, with a wide range of other services and products.

- Amazon: A retail giant that has expanded into cloud computing, streaming, and other tech-related services.

- Microsoft: A tech powerhouse with a strong presence in software, hardware, and cloud computing.

Case Study: Tesla

To illustrate the potential of investing in US tech stocks, let's consider the case of Tesla. Tesla is an electric vehicle manufacturer and clean energy company that has seen significant growth in recent years. By investing in Tesla, Australian investors can benefit from the company's strong fundamentals and potential for future growth.

Conclusion

Buying US tech stocks can be a valuable addition to your investment portfolio. By following these steps and conducting thorough research, Australian investors can identify and invest in promising US tech stocks. Remember to stay informed about market trends and currency exchange rates to maximize your investment returns.