Introduction:

The year 2025 marks another year of intense scrutiny for the US stock market. As investors and financial analysts alike ponder the possibility of a valuation bubble, the question on everyone's mind is whether the current market conditions are a cause for concern or simply a reflection of the economy's robustness. This article delves into the current US stock market valuation bubble analysis for 2025, examining key indicators, historical precedents, and potential outcomes.

Understanding Market Valuation:

To assess whether the US stock market is in a bubble, it's crucial to understand market valuation. Valuation refers to the price of an asset relative to its intrinsic worth. One common measure of market valuation is the price-to-earnings (P/E) ratio, which compares the market price of a stock to its per-share earnings. A P/E ratio that is significantly higher than the historical average can indicate overvaluation.

Current P/E Ratio Analysis:

As of 2025, the US stock market's P/E ratio has reached a level that has raised eyebrows among investors. The current P/E ratio, at 32.5, is notably higher than the historical average of around 15. This indicates that stocks are currently trading at a premium, potentially signaling an overvalued market.

Historical Precedents:

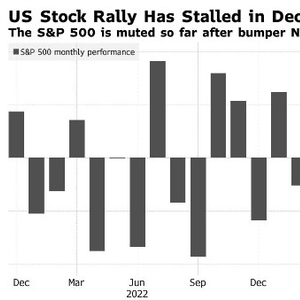

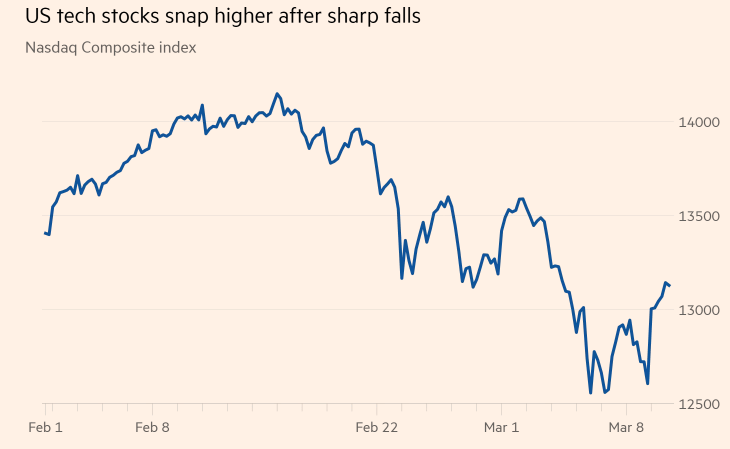

History has shown that overvalued markets can lead to bubbles, which often burst, causing significant market corrections. For instance, the dot-com bubble of the late 1990s and the housing bubble leading up to the 2008 financial crisis are prime examples. Both of these bubbles were characterized by excessive valuations, speculative trading, and a general sense of irrational exuberance.

Key Indicators of Bubble Formation:

Several indicators suggest that the current US stock market may be forming a bubble:

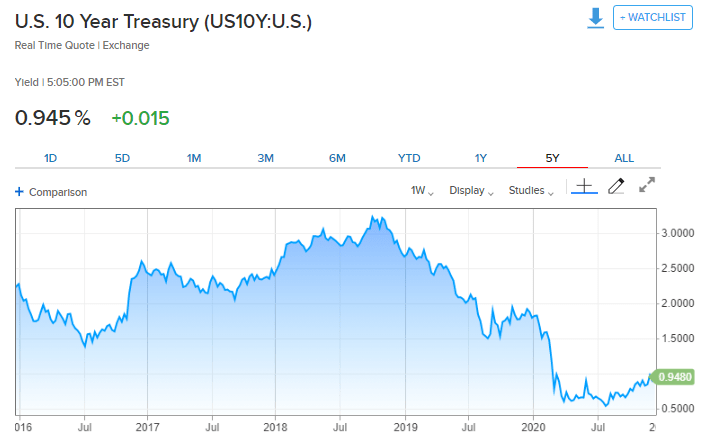

- Low Interest Rates: Central banks around the world have maintained low interest rates to stimulate economic growth, which has made bonds and other low-risk investments less attractive. This has driven investors into riskier assets like stocks, potentially inflating prices.

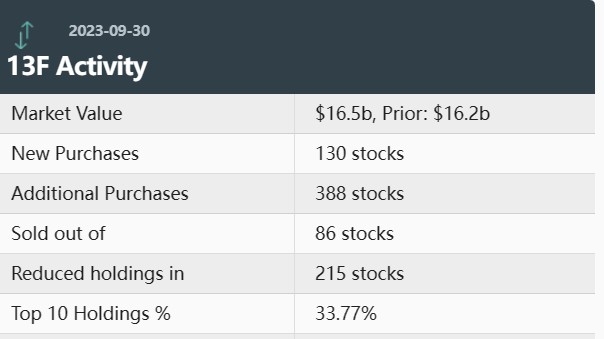

- Speculative Trading: The rise of trading platforms like Robinhood has made it easier for retail investors to participate in the stock market. This has led to increased speculative trading and a surge in popular stocks, often driven by social media hype.

- High Debt Levels: Corporate debt levels have reached record highs, raising concerns about the ability of companies to service their debt in the event of a market downturn.

Case Studies:

The tech sector has been a significant driver of the current stock market rally. Companies like Apple, Amazon, and Microsoft have seen their valuations soar, pushing the overall market higher. However, there are concerns that these valuations may be unsustainable, especially considering the high valuations of some of the newer tech companies.

Conclusion:

While the current US stock market valuation may indicate a bubble, it's important to note that bubbles are not always predictable or preventable. Investors should remain vigilant and consider diversifying their portfolios to mitigate potential risks. As the year 2025 unfolds, the stock market will continue to be closely watched, and investors will be looking for signs that the market is cooling off or if the bubble is about to burst.