In the global stock market, investors often find themselves weighing the pros and cons of different markets. One of the most common comparisons is between Canadian stocks and those in the United States. This article delves into a comprehensive comparison of these two markets, highlighting key differences and similarities.

Market Size and Liquidity

One of the first things to consider when comparing Canadian stocks to those in the US is market size and liquidity. The US stock market is the largest in the world, with a market capitalization of over $33 trillion. This vast size provides investors with a wide range of options and a high level of liquidity.

In contrast, the Canadian stock market is much smaller, with a market capitalization of around $2 trillion. While this may seem like a significant difference, the Canadian market is still considered one of the most liquid in the world, with a high level of trading activity.

Industry Composition

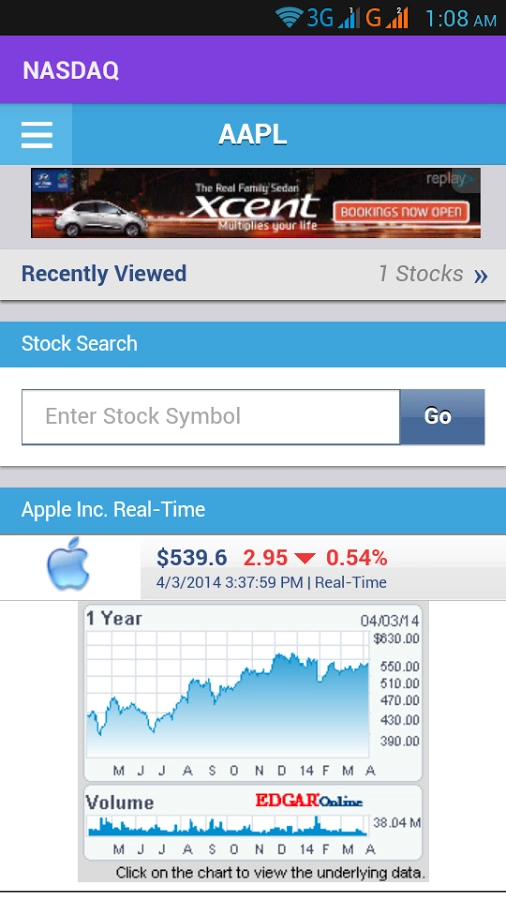

The industry composition of the Canadian and US stock markets also differs significantly. The US market is home to a diverse range of industries, including technology, healthcare, and consumer goods. Technology companies like Apple, Microsoft, and Google are among the largest and most influential in the world.

On the other hand, the Canadian market is heavily weighted towards natural resources, particularly oil and gas. Firms like Suncor Energy and Royal Dutch Shell are major players in the Canadian market. This can make the Canadian market more volatile, as it is more sensitive to changes in commodity prices.

Dividends and Yield

Another key difference between Canadian and US stocks is the dividend yield. The US market has a lower dividend yield compared to the Canadian market. This is due to the fact that many US companies reinvest their earnings back into the business, rather than distributing them to shareholders.

In contrast, Canadian companies tend to have higher dividend yields, making them attractive to income-seeking investors. This is especially true for companies in the energy and financial sectors.

Regulation and Taxation

The regulatory and taxation environments also differ between the two markets. The US has a more stringent regulatory framework, which can make it more challenging for companies to operate. However, this also provides a level of protection for investors.

In Canada, the regulatory environment is less stringent, which can make it easier for companies to operate. However, this can also lead to higher levels of risk.

From a taxation perspective, the US has a progressive tax system, which means the more you earn, the higher the tax rate. In Canada, the tax system is also progressive, but the rates are generally lower than in the US.

Conclusion

When comparing Canadian stocks to those in the US, it is clear that there are significant differences in market size, industry composition, dividend yields, and regulatory and taxation environments. Investors need to carefully consider these factors when deciding where to invest their money.

For those seeking exposure to the technology sector, the US market may be the better choice. However, for investors looking for higher dividend yields and exposure to natural resources, the Canadian market may be more attractive. Ultimately, the best choice depends on the individual investor's goals and risk tolerance.