Are you interested in investing in Alibaba, the world's largest online and mobile commerce company? If so, you might be wondering if you can buy Alibaba stock in the US. The answer is yes, you can! In this article, we'll explore how to invest in Alibaba stock, the benefits of investing in this company, and some key considerations to keep in mind.

Understanding Alibaba Stock

Alibaba Group Holding Limited (NYSE: BABA) is a Chinese multinational technology company that provides a comprehensive suite of business-to-business and business-to-consumer services. The company operates through various platforms, including Alibaba.com, Taobao, Tmall, and Alipay. With a market capitalization of over $500 billion, Alibaba is one of the most valuable companies in the world.

How to Buy Alibaba Stock in the US

To buy Alibaba stock in the US, you'll need to follow these steps:

Open a Brokerage Account: The first step is to open a brokerage account with a reputable online brokerage firm. Some popular options include Charles Schwab, Fidelity, and TD Ameritrade.

Fund Your Account: Once your account is set up, you'll need to fund it with cash or transfer funds from another brokerage account.

Place an Order: After funding your account, you can place an order to buy Alibaba stock. You can do this through your brokerage's online platform or by calling your broker.

Monitor Your Investment: Once you've purchased Alibaba stock, it's important to monitor your investment and stay informed about the company's performance and the broader market.

Benefits of Investing in Alibaba Stock

Investing in Alibaba stock offers several benefits:

Growth Potential: Alibaba has a strong track record of growth, and the company continues to expand its market presence both domestically and internationally.

Diversification: Investing in Alibaba can provide diversification to your portfolio, as the company operates in various industries, including e-commerce, cloud computing, and digital media.

Access to a Global Market: By investing in Alibaba, you gain exposure to the rapidly growing Chinese economy and the vast consumer market in China.

Key Considerations

Before investing in Alibaba stock, it's important to consider the following:

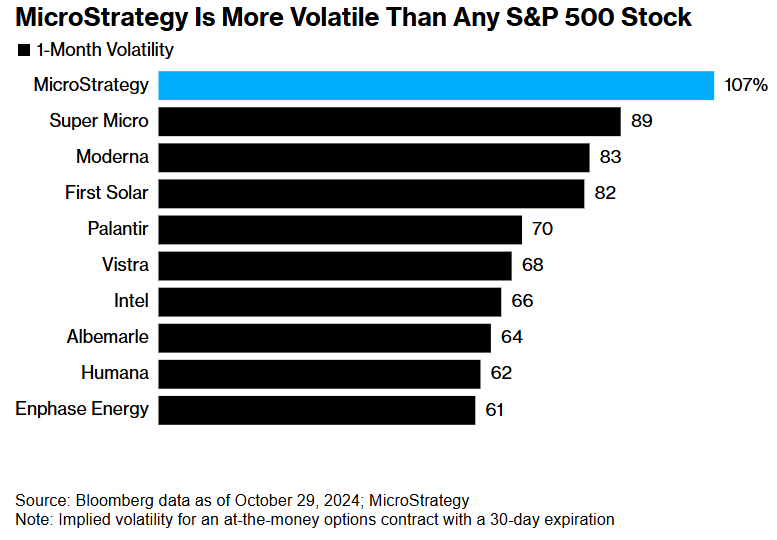

Market Risk: The stock market can be volatile, and investing in Alibaba is no exception. Be prepared for potential fluctuations in the stock price.

Currency Risk: Since Alibaba is a Chinese company, its stock price is denominated in US dollars. Fluctuations in the exchange rate can impact the value of your investment.

Regulatory Risk: As a Chinese company, Alibaba is subject to regulatory changes and political risks that could impact its operations and financial performance.

Case Study: Alibaba's IPO

In 2014, Alibaba went public on the New York Stock Exchange, becoming the largest IPO in history. The company's IPO raised $21.8 billion, and its stock price soared on the first day of trading. This event highlighted the significant interest in Alibaba and its potential for growth.

In conclusion, if you're looking to invest in Alibaba stock, you can do so through a brokerage account in the US. Investing in Alibaba offers several benefits, including growth potential and exposure to the Chinese market. However, it's important to consider the associated risks and stay informed about the company's performance and the broader market.