In the digital age, the world is more interconnected than ever before. This interconnectedness has opened up a world of opportunities for investors, including those in Nigeria, to invest in the U.S. stock market. But what does it take to buy U.S. stocks from Nigeria? This comprehensive guide will walk you through the process, providing you with the knowledge and tools you need to make informed investment decisions.

Understanding the U.S. Stock Market

The U.S. stock market is one of the largest and most diversified in the world, offering a wide range of investment opportunities. Whether you're looking to invest in large, well-established companies or smaller, emerging businesses, the U.S. stock market has something for everyone.

Setting Up an Investment Account

The first step in buying U.S. stocks from Nigeria is to set up an investment account with a reputable brokerage firm. There are several online brokers that offer services to Nigerian investors, including E*TRADE, Charles Schwab, and Fidelity. When choosing a brokerage firm, consider factors such as fees, customer service, and the range of investment options available.

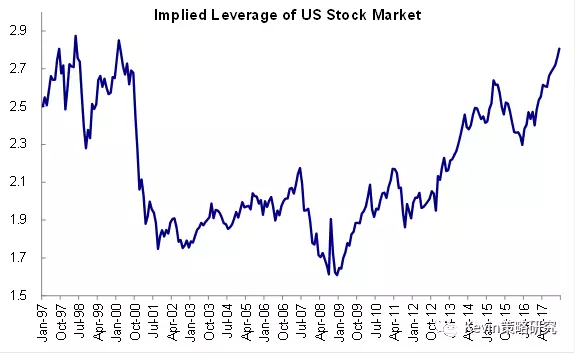

Understanding the Risks

Before diving into the U.S. stock market, it's important to understand the risks involved. The stock market can be volatile, and prices can fluctuate significantly. It's also important to be aware of currency exchange rates, as changes in the value of the Nigerian naira can impact your investment returns.

Researching and Selecting Stocks

Once you have your investment account set up, the next step is to research and select the stocks you want to buy. This involves analyzing the financial health of the company, its industry position, and market trends.

Using Online Tools for Research

Several online tools can help you research and analyze stocks. Websites like Yahoo Finance, Morningstar, and Seeking Alpha provide a wealth of information, including financial statements, stock charts, and analyst reports.

Case Study: Investing in Apple (AAPL)

Let's say you're interested in investing in Apple Inc. (AAPL). After conducting your research, you find that the company has a strong track record of growth, a loyal customer base, and innovative products. You decide to purchase 100 shares of Apple stock at

Conclusion

Buying U.S. stocks from Nigeria is a viable and potentially profitable investment strategy. By following this guide, you can navigate the complexities of the U.S. stock market and make informed investment decisions. Remember to do your research, understand the risks, and invest wisely.