In the dynamic world of stock markets, identifying stocks with short-term momentum is crucial for investors seeking quick gains. This article delves into the strategies employed by financial analysts to pinpoint stocks poised for a surge in the near future. We'll explore various methods, provide practical examples, and guide you through the process of identifying short-term momentum stocks.

Understanding Short-Term Momentum

Short-term momentum refers to the upward or downward movement of a stock's price over a relatively brief period, typically a few days to a few weeks. Analysts who specialize in short-term momentum often focus on technical indicators, market trends, and company-specific news to predict these price movements.

Key Strategies for Identifying Short-Term Momentum Stocks

Technical Analysis: This approach involves studying past stock price movements to predict future trends. Common technical indicators include Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands. For example, an RSI above 70 indicates overbought conditions, suggesting a potential sell-off, while an RSI below 30 indicates oversold conditions, suggesting a potential buying opportunity.

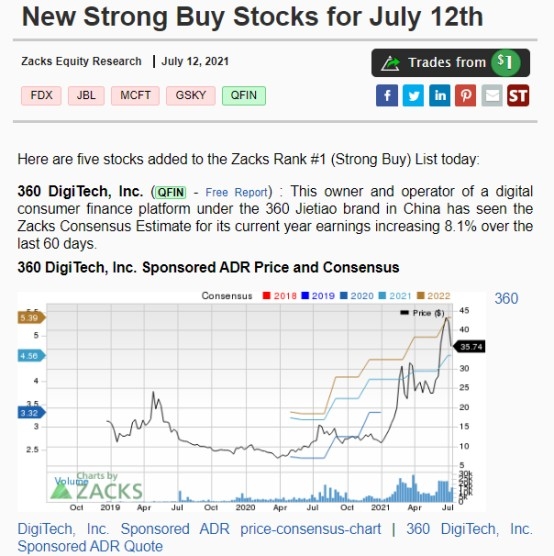

Fundamental Analysis: This method involves evaluating a company's financial health, earnings, and business prospects. Strong earnings reports or positive news about a company can drive short-term momentum. For instance, a tech company releasing a groundbreaking product can lead to a surge in its stock price.

Market Trends: Economic indicators, sector trends, and global events can influence short-term momentum. For example, a decline in interest rates can boost the stock prices of financial institutions, while geopolitical tensions might negatively impact energy stocks.

News and Sentiment Analysis: Keeping an eye on the latest news and market sentiment is crucial. Positive news about a stock can drive its price up, while negative sentiment can lead to a decline. This can be achieved by following financial news outlets, social media, and investor forums.

Case Studies: Short-Term Momentum Stocks

Tesla (TSLA): In 2021, Tesla's stock experienced a significant surge following the release of its new Cybertruck. The stock rose by over 10% in just a few days, driven by positive sentiment and strong sales projections.

AAPL: Apple's stock has often exhibited short-term momentum due to its consistent earnings growth and innovative products. For instance, the announcement of the iPhone 13 series in September 2021 led to a surge in the stock, with a 3% increase in just a few days.

Conclusion

Identifying short-term momentum stocks requires a combination of technical analysis, fundamental analysis, and market research. By staying informed about market trends, news, and company-specific developments, investors can capitalize on short-term opportunities. Remember, while short-term momentum can lead to significant gains, it also comes with higher risks. Always conduct thorough research and consider consulting with a financial advisor before making investment decisions.