The recent developments in Afghanistan have sparked widespread concern across the globe, including the United States. The situation in Afghanistan has a direct impact on the US stock market, as investors closely monitor geopolitical events that could affect the global economy. This article delves into the potential effects of the Afghanistan crisis on the US stock market, providing insights into how investors can navigate this volatile period.

Geopolitical Uncertainty and Market Volatility

The withdrawal of US troops from Afghanistan has led to a surge in violence and instability in the region. This geopolitical uncertainty has raised concerns about the stability of energy supplies, economic growth, and global security. As a result, investors have become increasingly cautious, leading to increased market volatility.

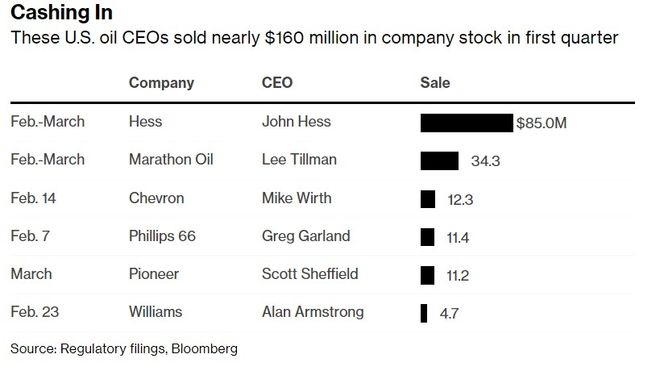

Energy Sector Implications

Afghanistan is a significant producer of natural gas and other energy resources. The instability in the region has raised concerns about the security of these energy supplies, which could lead to higher energy prices globally. This has had a direct impact on the energy sector in the US stock market, with major energy companies experiencing significant fluctuations in their share prices.

Case Study: ExxonMobil

ExxonMobil, one of the largest oil and gas companies in the world, has seen its share price fluctuate significantly in response to the situation in Afghanistan. In the weeks following the withdrawal of US troops, ExxonMobil's share price dropped by over 5%. This highlights the vulnerability of the energy sector to geopolitical events.

Economic Growth Concerns

The instability in Afghanistan has also raised concerns about the global economic outlook. As one of the largest economies in the world, the US is closely tied to the global economy. The situation in Afghanistan could lead to a slowdown in economic growth, which would have a negative impact on the US stock market.

Case Study: Technology Sector

The technology sector has also been affected by the situation in Afghanistan. Companies like Apple and Microsoft, which rely on components and materials sourced from various countries, have expressed concerns about the potential disruptions in the supply chain. This has led to a decline in their share prices, as investors become increasingly cautious.

Investor Strategies

Given the current geopolitical uncertainty, investors need to adopt a cautious approach. Here are some strategies to consider:

- Diversification: Diversifying your portfolio can help mitigate the risks associated with geopolitical events.

- Risk Management: Implementing risk management strategies, such as stop-loss orders, can help protect your investments.

- Stay Informed: Keeping up-to-date with the latest news and developments can help you make informed investment decisions.

Conclusion

The situation in Afghanistan has had a significant impact on the US stock market, with investors closely monitoring the situation. As geopolitical uncertainty continues to rise, it is crucial for investors to stay informed and adopt a cautious approach. By diversifying their portfolios and implementing risk management strategies, investors can navigate this volatile period and protect their investments.