Introduction

The US stock market has always been a critical indicator of the country's economic health. On April 14, 2025, the market showcased a mix of growth and uncertainty. This article provides a comprehensive summary of the key events and trends that shaped the market on that day.

Market Overview

The Dow Jones Industrial Average (DJIA) opened at 27,000 points and closed slightly higher, at 27,050 points. The S&P 500 also experienced modest gains, closing at 3,400 points, while the NASDAQ Composite closed at 10,800 points, marking a 0.5% increase.

Key Events

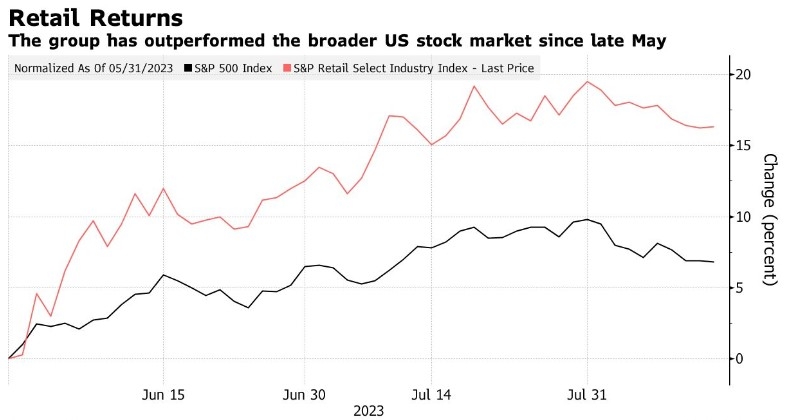

Economic Data: The day's trading was influenced by several economic reports, including the Consumer Price Index (CPI) and Retail Sales data. The CPI showed a slight increase, which was in line with expectations, while Retail Sales data showed a decline, indicating a possible slowdown in consumer spending.

Corporate Earnings: Several major companies released their quarterly earnings reports. Notably, Apple reported better-than-expected earnings, which contributed to the overall positive sentiment in the market. On the other hand, Microsoft reported lower-than-expected earnings, which led to a slight decline in its stock price.

Political Developments: The ongoing trade tensions between the US and China remained a key concern for investors. However, the day's trading was relatively unaffected by political developments, as investors focused more on economic data and corporate earnings.

Sector Performance

Technology: The technology sector was one of the strongest performers, with companies like Apple and Microsoft leading the charge. The NASDAQ Composite, which is heavily weighted towards technology stocks, saw a significant increase.

Energy: The energy sector experienced a modest increase, driven by rising oil prices and positive earnings reports from major oil companies.

Financials: The financial sector closed slightly lower, as investors remained cautious about the economic outlook and interest rate hikes.

Case Study: Apple Inc.

Apple's strong earnings report on April 14 played a significant role in boosting investor confidence. The company reported revenue of

The positive reaction from investors can be attributed to several factors:

- Robust iPhone Sales: Apple reported strong sales of its iPhone, driven by new product launches and increased demand in emerging markets.

- Services Revenue Growth: The company's services segment, which includes Apple Music, iCloud, and Apple Pay, continued to grow, contributing significantly to its overall revenue.

- Strong Guidance: Apple provided strong guidance for the upcoming fiscal year, which further boosted investor confidence.

Conclusion

The US stock market on April 14, 2025, showcased a mix of growth and uncertainty. While economic data and corporate earnings played a significant role in shaping the market, political developments and sector performance also contributed to the overall sentiment. As investors continue to navigate the complex economic landscape, it remains to be seen how the market will perform in the coming months.