Are you considering investing in the US Steel stock offering? If so, you've come to the right place. This article will delve into the details of the US Steel stock offering, including its potential benefits, risks, and key factors to consider before making your investment decision.

Understanding the US Steel Stock Offering

The US Steel stock offering refers to the sale of shares of the company to the public. This is a significant event for investors, as it presents an opportunity to own a piece of one of the largest steel producers in the United States.

Why Invest in US Steel?

There are several reasons why investors might consider investing in US Steel:

- Strong Market Position: US Steel is a leading player in the steel industry, with a strong market position and a diverse product portfolio.

- Growth Potential: The demand for steel is expected to grow in the coming years, driven by infrastructure projects, automotive manufacturing, and other industries.

- Dividends: US Steel has a history of paying dividends to its shareholders, providing a potential source of income.

Risks to Consider

While there are benefits to investing in US Steel, there are also risks to consider:

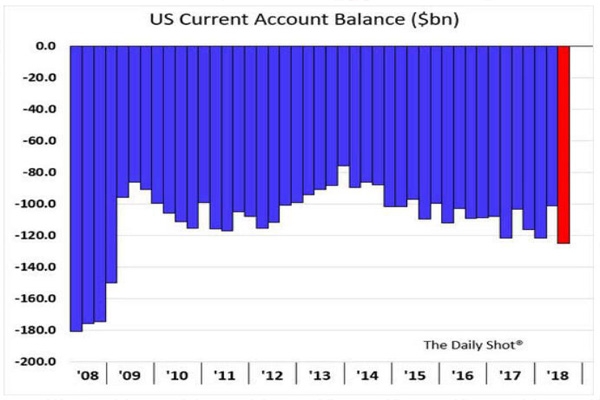

- Economic Factors: The steel industry is sensitive to economic conditions, and a downturn in the economy could negatively impact US Steel's performance.

- Competition: The steel industry is highly competitive, and US Steel may face challenges from both domestic and international competitors.

- Regulatory Changes: Changes in regulations could impact the profitability of US Steel.

Key Factors to Consider

Before investing in US Steel, it's important to consider the following factors:

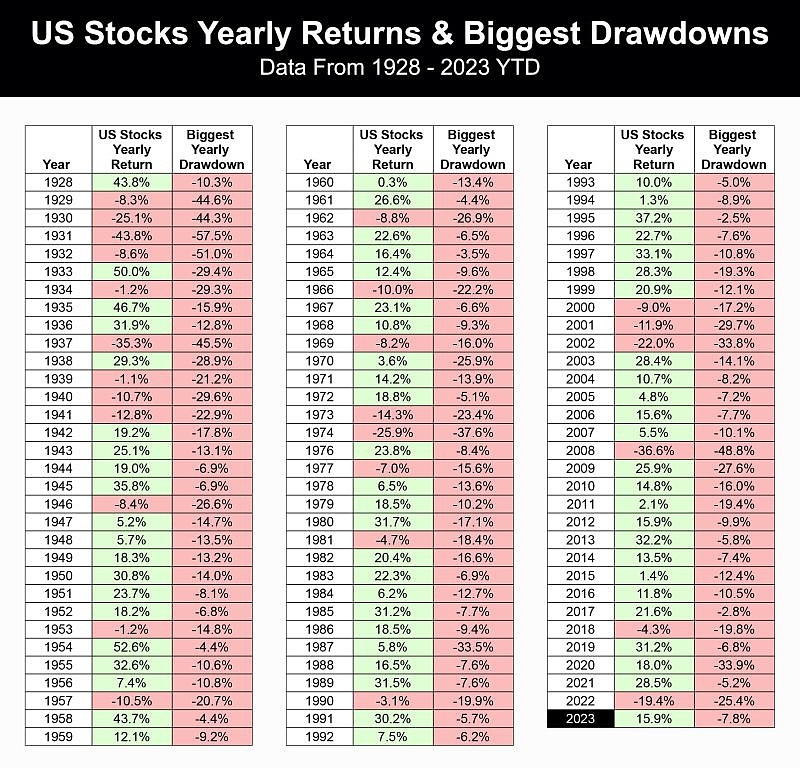

- Financial Performance: Review US Steel's financial statements, including its revenue, earnings, and cash flow, to assess its financial health.

- Valuation: Compare US Steel's valuation to its peers in the steel industry to determine if it is overvalued or undervalued.

- Management: Evaluate the quality of US Steel's management team and their track record in driving the company's success.

Case Study: US Steel's Recent Stock Offering

In 2021, US Steel completed a significant stock offering, raising $1.6 billion. This offering was well-received by investors, as it provided an opportunity to invest in a leading steel producer with strong growth prospects.

Conclusion

Investing in the US Steel stock offering can be a wise decision for investors looking to gain exposure to the steel industry. However, it's important to carefully consider the potential risks and benefits before making your investment decision. By conducting thorough research and analysis, you can make an informed decision about whether US Steel is the right investment for you.