The stock market has always been a place where investors can make substantial gains, but it has also been notorious for its volatility and potential for bubbles. The question on many investors' minds is whether the US stock market is currently in a bubble. In this article, we will explore the signs that indicate whether the market is overvalued and if a bubble may be forming.

Understanding the Stock Market Bubble

A stock market bubble occurs when the price of stocks becomes detached from their intrinsic value, driven by excessive optimism and speculative buying. This often leads to a sudden and dramatic collapse when the bubble bursts, causing significant losses for investors.

Signs of a Bubble

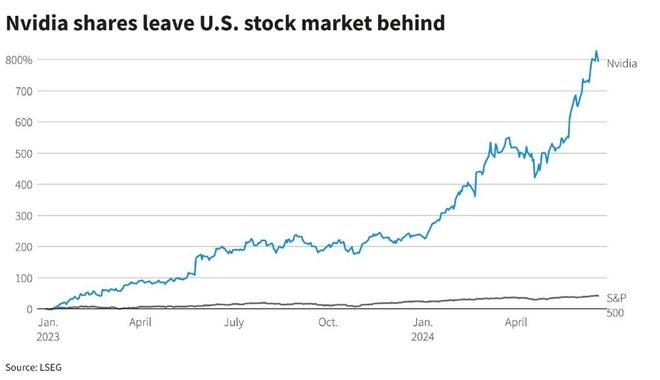

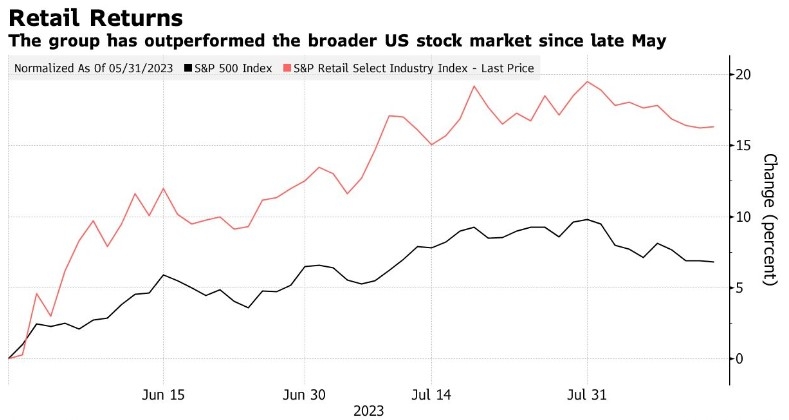

Record High Valuations: One of the most obvious signs of a bubble is when stock prices reach record highs. The S&P 500, for example, has been hitting new all-time highs, raising concerns about whether the market is overvalued.

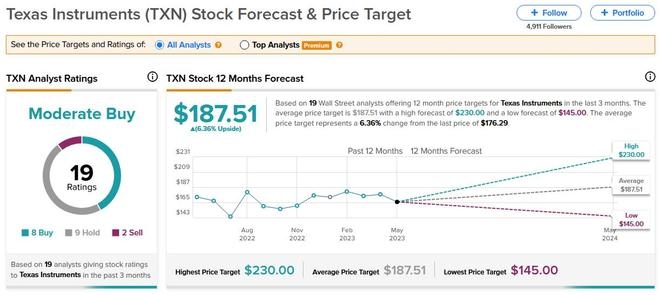

Rising P/E Ratios: The price-to-earnings (P/E) ratio is a measure of how much investors are willing to pay for each dollar of earnings. When P/E ratios rise significantly above historical averages, it suggests that stocks may be overvalued.

Speculative Mania: Another sign of a bubble is when investors become overly optimistic and start buying stocks based on hype rather than fundamentals. This speculative mania can drive stock prices to unsustainable levels.

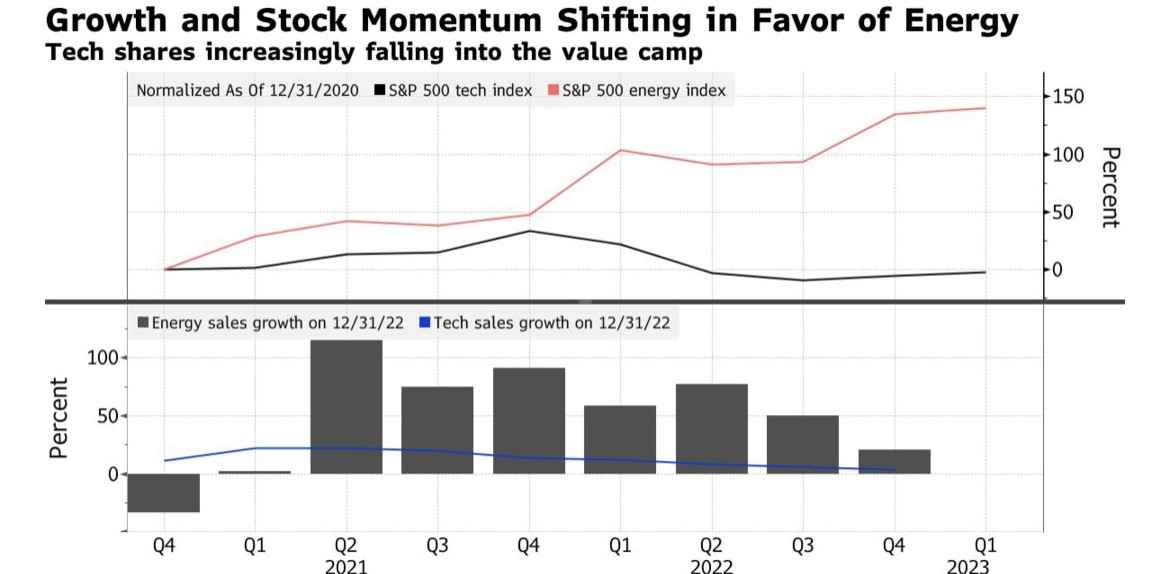

Lack of Fundamental Analysis: When investors focus more on the potential for short-term gains rather than the long-term fundamentals of a company, it can indicate a bubble.

Analyzing the Current Market

Several factors suggest that the US stock market may be approaching a bubble:

Record High P/E Ratios: The S&P 500's P/E ratio has been hovering around 30, significantly higher than its historical average of around 15-20.

Speculative Mania: The rise of meme stocks, such as GameStop and AMC, has highlighted the speculative nature of the current market.

Lack of Fundamental Analysis: Many investors are focusing on short-term gains, ignoring the long-term fundamentals of companies.

Case Study: Tech Stocks

One of the most notable sectors currently experiencing a speculative mania is technology. Companies like Apple, Microsoft, and Amazon have seen their stock prices soar, driven by speculative buying and hype rather than fundamentals.

Conclusion

While it is difficult to predict when a bubble will burst, the signs of an overvalued stock market are becoming increasingly apparent. Investors should be cautious and consider the long-term fundamentals of companies before making investment decisions. As always, it's crucial to conduct thorough research and seek advice from financial professionals before investing in the stock market.