Introduction:

The US oil stock market is a significant sector within the global energy industry, offering investors a range of opportunities to capitalize on the dynamic nature of oil prices and production. With the rise of renewable energy sources, the oil market has evolved, making it essential for investors to stay informed about the various factors influencing stock prices. This article aims to provide a comprehensive overview of the US oil stock market, covering key aspects, including market dynamics, influential factors, and investment strategies.

Market Dynamics

The US oil stock market is characterized by a diverse range of companies, from major oil producers to exploration and production (E&P) firms, refining companies, and oilfield service providers. These companies are listed on major stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ.

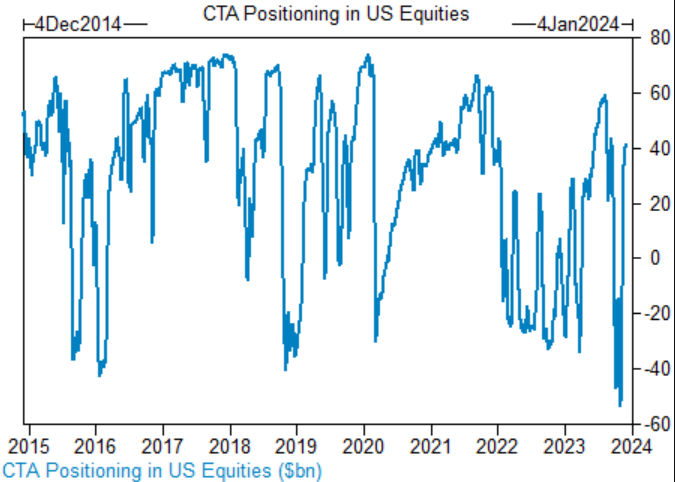

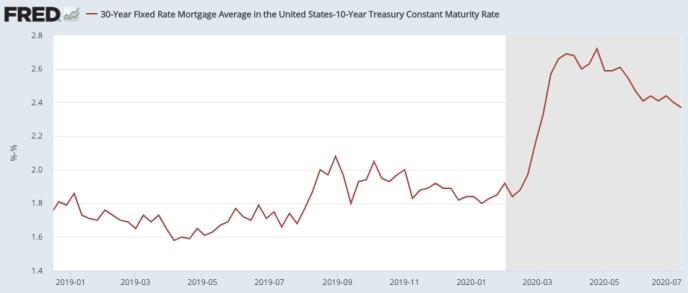

The market is driven by the supply and demand of oil, as well as geopolitical events, technological advancements, and regulatory changes. Fluctuations in oil prices significantly impact the profitability of these companies, making the market highly volatile.

Influential Factors

Several factors influence the US oil stock market, including:

- Oil Prices: The price of oil is the primary driver of stock prices in the oil market. Factors such as global demand, geopolitical events, and supply disruptions can cause oil prices to fluctuate significantly.

- Production Levels: The level of oil production in the US and other major oil-producing countries can impact oil prices and, subsequently, stock prices.

- Regulatory Changes: Changes in environmental regulations, such as the Clean Power Plan, can impact the profitability of oil companies and influence stock prices.

- Technological Advancements: Technological advancements in drilling and production can reduce costs and increase production, impacting the overall market.

Investment Strategies

Investing in the US oil stock market requires a thorough understanding of market dynamics and influential factors. Here are some investment strategies to consider:

- Diversification: Diversifying your investments across different oil-related companies and sectors can help mitigate risks associated with market volatility.

- Long-Term Investment: Investing in oil stocks for the long term can provide significant returns, as the market tends to recover from downturns.

- Research and Analysis: Conducting thorough research and analysis of the companies you are considering investing in is crucial to identify potential risks and opportunities.

- Stay Informed: Keeping up-to-date with market news, regulatory changes, and geopolitical events can help you make informed investment decisions.

Case Study: ExxonMobil

ExxonMobil is one of the largest oil companies in the world, with a significant presence in the US oil stock market. The company's stock price has been influenced by various factors, including oil prices and regulatory changes.

In 2019, ExxonMobil announced a $15 billion investment in renewable energy, signaling its commitment to diversifying its business. Despite the investment, the company's stock price remained relatively stable, indicating the resilience of the company in the face of market challenges.

Conclusion:

The US oil stock market is a complex and dynamic sector, influenced by a range of factors. Understanding market dynamics, influential factors, and investment strategies is crucial for investors looking to capitalize on this lucrative market. By staying informed and adopting a long-term investment approach, investors can navigate the challenges and opportunities of the US oil stock market.