In the ever-evolving world of finance, the stock market continues to be a focal point for investors and analysts alike. As we delve into the data and trends for October 20, 2025, this article aims to provide a comprehensive analysis of the US stock market, highlighting key developments and insights.

Market Overview

On October 20, 2025, the US stock market displayed a mix of gains and losses across various sectors. The Dow Jones Industrial Average closed slightly higher, while the S&P 500 and the Nasdaq Composite ended the day with minor declines. This volatility reflects the dynamic nature of the market and the impact of various global and domestic factors.

Sector Performance

Technology Stocks: Technology stocks have been a significant driver of market performance, with companies like Apple, Microsoft, and Amazon leading the pack. Amazon, in particular, has seen remarkable growth, largely driven by its cloud computing services and e-commerce business. However, concerns regarding rising interest rates and inflation have led to some corrections in the tech sector.

Healthcare Stocks: The healthcare sector has emerged as a stable performer, with companies in biotechnology, pharmaceuticals, and medical devices leading the charge. Biogen has been a standout performer, with its successful drug launches and advancements in Alzheimer's disease treatment. Additionally, Medtronic has seen significant growth due to its innovative medical devices and expansion into new markets.

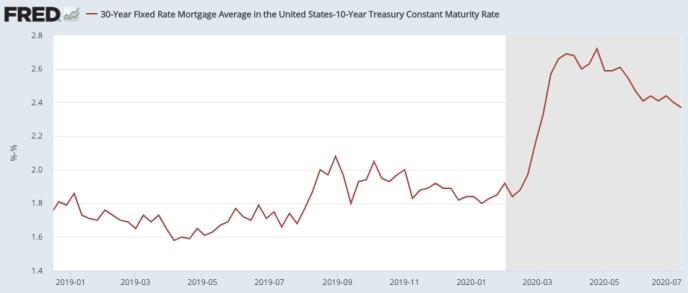

Financial Stocks: Financial stocks have faced challenges in recent months, with rising interest rates and economic uncertainties weighing on the sector. However, JPMorgan Chase and Bank of America have managed to stay afloat, reporting strong earnings and showing resilience in a tough market environment.

Market Sentiment and Economic Indicators

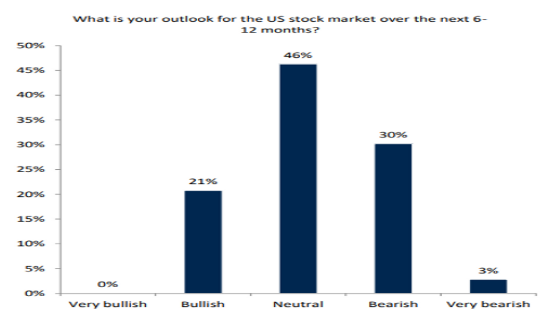

Market sentiment remains cautious, with investors closely monitoring economic indicators such as inflation, unemployment rates, and consumer spending. The latest inflation data released by the Bureau of Labor Statistics revealed a slight decline in the Consumer Price Index, offering some relief to investors. However, the unemployment rate remains high, prompting concerns about the economic recovery and consumer spending.

Geopolitical Factors

Geopolitical tensions have also played a role in shaping market dynamics. The ongoing tensions between the United States and China have created uncertainty and volatility in the market. Investors are closely monitoring trade negotiations and any potential escalations that could impact global economic stability.

Case Study: Tesla, Inc.

A notable case study is Tesla, Inc., which has seen a remarkable rise in stock value over the past few years. Tesla's success can be attributed to its innovative electric vehicle technology and commitment to sustainable energy solutions. The company's expansion into battery production and the launch of new models have contributed to its impressive performance. However, concerns regarding production delays and increased competition have led to some volatility in the stock price.

Conclusion

As we analyze the US stock market on October 20, 2025, it is clear that the market remains dynamic and subject to various global and domestic factors. Investors must remain vigilant and stay informed about market trends, economic indicators, and geopolitical developments to make informed investment decisions. While the market has faced challenges, there are opportunities for growth in various sectors, particularly in technology, healthcare, and sustainable energy.