Introduction:

Investing in the right stocks can significantly boost your financial growth, especially when it comes to tax-advantaged accounts like the RRSP (Registered Retirement Savings Plan). By incorporating US dividend stocks into your RRSP, you can potentially enjoy higher returns while minimizing your tax liability. In this article, we will explore the benefits of investing in US dividend stocks within an RRSP and provide some valuable insights on how to make the most out of this investment strategy.

Understanding RRSPs and Dividend Stocks

An RRSP is a tax-deferred savings account that allows Canadians to contribute pre-tax income, which can grow tax-free until you withdraw it during retirement. Dividend stocks are shares of companies that pay out a portion of their earnings to shareholders, providing a regular income stream.

By combining the tax advantages of an RRSP with the income-generating potential of dividend stocks, investors can create a powerful portfolio that can help them achieve their retirement goals.

Benefits of Investing in US Dividend Stocks in RRSP

Tax Deferral: Since RRSP contributions are made with pre-tax income, the taxes are deferred until you withdraw the funds during retirement. This can be particularly beneficial if you expect to be in a lower tax bracket during retirement.

Potential for Higher Returns: The US stock market has historically offered higher returns compared to the Canadian market. Investing in US dividend stocks can provide you with access to a broader range of companies and potentially higher dividend yields.

Currency Diversification: By investing in US dividend stocks, you can diversify your portfolio away from the Canadian dollar, which can help protect against currency fluctuations.

Regular Income Stream: Dividend stocks provide a steady stream of income, which can be especially valuable during retirement when you may have limited sources of income.

How to Invest in US Dividend Stocks in RRSP

Research and Select Stocks: Begin by researching companies with strong dividend histories and solid financial health. Look for companies with consistent earnings growth, stable dividend payments, and low debt levels.

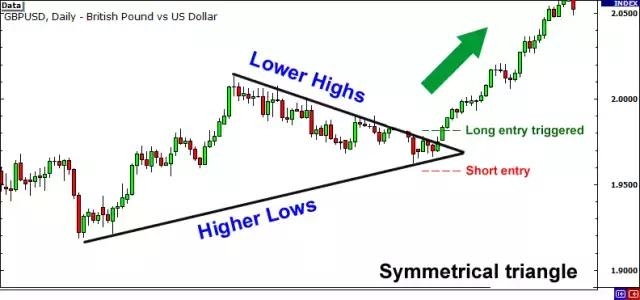

Diversify Your Portfolio: Diversification is key to reducing risk. Consider investing in a mix of industries and sectors to protect your portfolio against market volatility.

Stay Informed: Keep up with the latest news and financial reports of the companies you invest in. This will help you make informed decisions and stay ahead of potential risks.

Monitor Your Portfolio: Regularly review your investments to ensure they align with your financial goals and risk tolerance. Be prepared to adjust your portfolio as needed.

Case Study: Canadian National Railway (CNR)

As an example, let's consider Canadian National Railway (CNR), a well-established US dividend stock. CNR has a long history of paying dividends and has increased its dividend payments each year for the past several decades. By investing in CNR within your RRSP, you can benefit from its stable dividend payments while enjoying the tax advantages of the RRSP.

Conclusion:

Investing in US dividend stocks within an RRSP can be a smart strategy for Canadians looking to maximize their retirement savings. By understanding the benefits and carefully selecting dividend stocks, you can create a diversified portfolio that can potentially provide you with a steady income stream during retirement. Remember to stay informed and monitor your investments to ensure they align with your financial goals.