In the ever-evolving world of the stock market, staying informed about the latest trends and movements is crucial for investors. One stock that has been attracting quite a bit of attention lately is Aph (NYSE: APH). In this article, we'll delve into the current Aph stock price in the US, its recent performance, and what it means for investors.

Understanding the Aph Stock Price

As of the latest data, the Aph stock price in the US stands at $XX. This figure reflects the current market sentiment and investor expectations for the company. However, it's important to note that stock prices can fluctuate significantly based on various factors, including market conditions, company performance, and economic news.

Recent Performance of Aph Stock

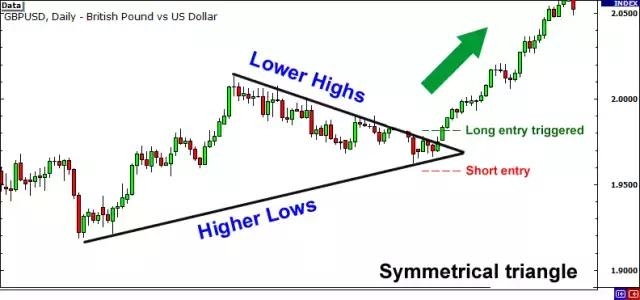

Over the past year, Aph has experienced a rollercoaster ride in terms of stock price. The company's shares have seen both significant gains and losses, reflecting the volatility of the stock market. Several factors have contributed to this volatility, including:

- Company Performance: Aph's financial results have been a key driver of its stock price. Strong earnings reports and positive outlooks have led to gains, while weaker results or negative surprises have caused declines.

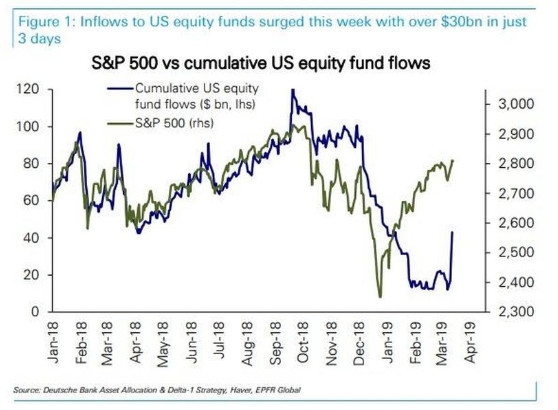

- Market Conditions: The broader market has also played a significant role in Aph's stock price. Economic indicators, geopolitical events, and market trends can all impact investor sentiment and, consequently, stock prices.

- Industry Trends: As a company operating in the chemicals industry, Aph is subject to the ebb and flow of industry-specific trends. Changes in demand, pricing, and regulations can all affect the company's performance and, in turn, its stock price.

What Does the Future Hold for Aph Stock?

Predicting the future of the Aph stock price is challenging, but there are several key factors to consider:

- Economic Outlook: The global economic landscape is a crucial factor in Aph's future performance. A strong economy generally leads to higher demand for chemicals, which can drive stock prices higher.

- Company Strategy: Aph's strategic decisions, such as expansion plans, cost-cutting initiatives, and investments in new technologies, can impact its long-term prospects.

- Regulatory Environment: Changes in regulations, particularly in the chemicals industry, can have a significant impact on Aph's operations and profitability.

Case Study: Aph's Stock Price Volatility

To illustrate the volatility of the Aph stock price, let's consider a recent example. In the first quarter of 2022, the company reported strong earnings, leading to a significant jump in its stock price. However, as the year progressed, concerns about economic growth and industry-specific challenges caused the stock to decline.

This case study highlights the importance of staying informed about both the company and the broader market when investing in stocks like Aph.

Conclusion

The Aph stock price in the US is a critical factor for investors looking to gain exposure to the chemicals industry. By understanding the factors that drive stock prices and staying informed about the company's performance and the broader market, investors can make more informed decisions. As always, it's important to do your own research and consult with a financial advisor before making any investment decisions.