Introduction: In recent years, the cryptocurrency market has experienced significant growth, and Bitcoin, the world's first decentralized digital currency, has played a pivotal role in this evolution. As a result, the demand for Bitcoin mining has surged, leading to a rise in US Bitcoin mining stocks. This article provides a comprehensive guide to understanding the US Bitcoin mining stock market, highlighting key players, factors to consider when investing, and potential risks involved.

Understanding Bitcoin Mining Stocks

Bitcoin mining is the process by which new bitcoins are entered into circulation. Miners use computers to solve complex mathematical problems, and in return, they are rewarded with bitcoins. Bitcoin mining stocks represent shares in companies that are involved in the Bitcoin mining industry, either directly or indirectly.

Key Players in the US Bitcoin Mining Stock Market

Several US-based companies have made significant investments in Bitcoin mining, making them key players in the market. Some of the prominent names include:

- Bitmain: As one of the largest Bitcoin mining hardware manufacturers, Bitmain has a strong presence in the US Bitcoin mining stock market.

- MicroStrategy: This company has made headlines by investing heavily in Bitcoin, including purchasing mining equipment and data centers.

- Hive Blockchain Technologies: Hive Blockchain is a public company listed on the Toronto Stock Exchange and the London Stock Exchange, with a significant presence in the US Bitcoin mining stock market.

Factors to Consider When Investing in US Bitcoin Mining Stocks

When considering investing in US Bitcoin mining stocks, there are several factors to keep in mind:

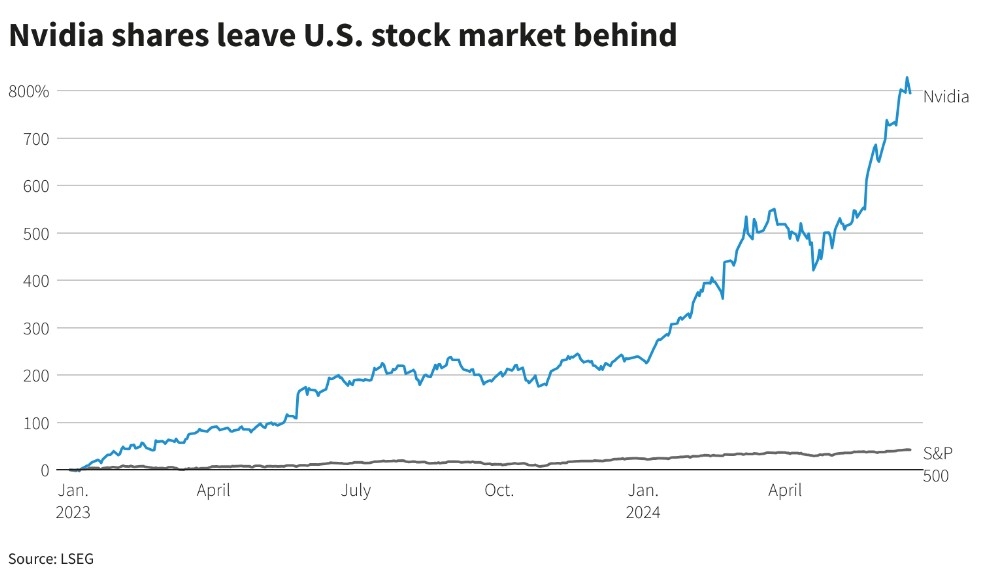

- Market Trends: Stay updated with the latest market trends and developments in the cryptocurrency industry.

- Regulatory Environment: Be aware of any regulatory changes that may impact the Bitcoin mining industry.

- Energy Efficiency: Companies with higher energy efficiency in their mining operations tend to be more profitable.

- Geographic Location: Mining operations in regions with cheaper electricity tend to be more cost-effective.

Risks Involved in Investing in US Bitcoin Mining Stocks

Investing in US Bitcoin mining stocks carries certain risks, including:

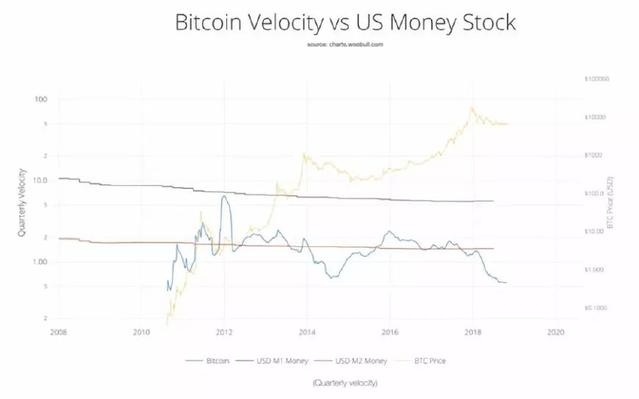

- Market Volatility: The cryptocurrency market is highly volatile, which can lead to significant price fluctuations in Bitcoin mining stocks.

- Regulatory Risks: Changes in regulations can impact the profitability of Bitcoin mining operations.

- Operational Risks: Mining operations can face technical and operational challenges, leading to downtime and reduced profitability.

Case Study: Bitmain

Bitmain, a leading Bitcoin mining hardware manufacturer, has experienced significant growth in the US Bitcoin mining stock market. The company's strong market position and innovative products have contributed to its success. However, it is essential to note that Bitmain's stock price has been highly volatile, reflecting the broader market trends in the cryptocurrency industry.

Conclusion:

Investing in US Bitcoin mining stocks can be a lucrative opportunity, but it is crucial to conduct thorough research and consider the associated risks. By staying informed about market trends, regulatory changes, and the operational efficiency of mining companies, investors can make informed decisions and potentially benefit from the growth of the Bitcoin mining industry.