Introduction

In recent times, the US stock market has experienced a downward trend that has left investors worried and seeking answers. The stock market is a complex entity, and understanding why it's going down can be crucial for making informed decisions. This article aims to delve into the reasons behind the falling US stocks and what it means for investors.

Reasons for the Decline

1. Economic Concerns

One of the primary reasons for the downward trend in US stocks is economic concerns. Issues such as inflation, rising interest rates, and economic uncertainty can significantly impact stock prices. For instance, when inflation is high, companies may struggle to maintain profitability, leading to a decrease in stock prices.

2. Geopolitical Factors

Geopolitical tensions, such as trade wars and geopolitical conflicts, can also contribute to the downward trend in US stocks. These factors create uncertainty in the market, leading to volatility and a decline in stock prices.

3. Tech Stocks Leading the Decline

Technology stocks, which have been a significant part of the US stock market, have also been contributing to the downward trend. The rise of antitrust concerns and regulatory scrutiny have put pressure on these companies, leading to a decline in their stock prices.

4. Market Overvaluation

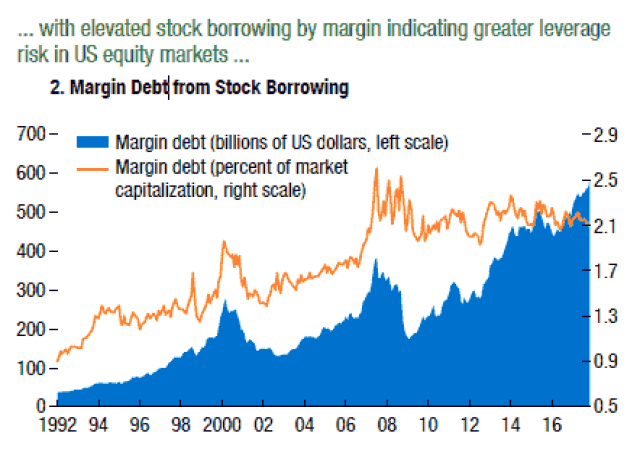

Another reason for the decline in US stocks is market overvaluation. In recent years, the stock market has been characterized by high valuations, which have made it vulnerable to a correction. As a result, when market conditions change, these overvalued stocks tend to decline significantly.

Impact on Investors

The downward trend in US stocks can have a significant impact on investors. Stock market corrections can lead to losses for investors, particularly those who are overexposed to certain sectors or companies. It is crucial for investors to understand the risks and be prepared for market volatility.

Case Studies

1. Tech Stocks: The Decline of Facebook

One of the notable cases is the decline of Facebook's stock. In the face of antitrust concerns and regulatory scrutiny, Facebook's stock has been on a downward trend. This case highlights the impact of regulatory issues on technology stocks.

2. Tech Giant Apple: Overvalued or Ready to Correct?

Another case to consider is Apple. Despite its strong financial performance, Apple's stock has been characterized by high valuations. This has led some investors to question whether Apple's stock is overvalued and ripe for a correction.

Conclusion

Understanding the reasons behind the downward trend in US stocks is crucial for investors. Economic concerns, geopolitical factors, market overvaluation, and regulatory issues all play a role in this trend. By being aware of these factors, investors can make more informed decisions and better manage their investments during market volatility.