Introduction: The US Airways stock market has been a topic of great interest among investors and industry experts alike. With its rich history and recent merger with American Airlines, the stock has seen its fair share of ups and downs. In this article, we will delve into the key factors influencing the US Airways stock market, provide a historical overview, and analyze its current performance.

Historical Overview: US Airways, originally founded in 1939 as All American Aviation, has undergone several transformations over the years. The airline merged with America West Airlines in 2005, and later in 2013, it merged with American Airlines to form the largest airline in the world by fleet size. This merger brought about significant changes in the stock market performance of US Airways.

Key Factors Influencing the Stock Market:

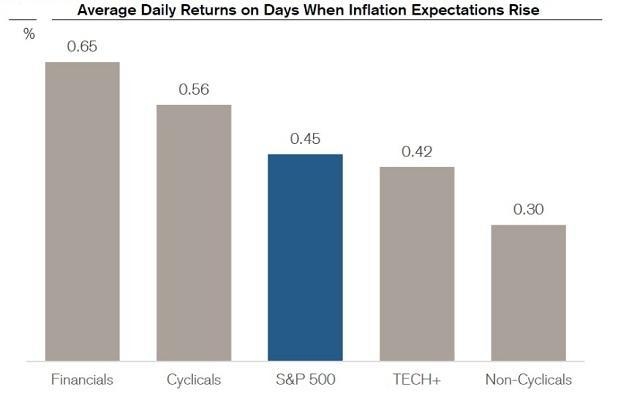

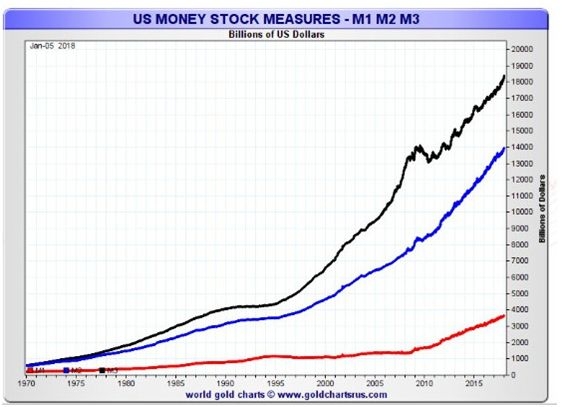

Economic Factors: The US economy plays a crucial role in the airline industry, and consequently, the stock market performance of US Airways. Economic indicators such as GDP growth, inflation rates, and consumer spending directly impact the demand for air travel and, in turn, the airline's revenue.

Fuel Prices: Fuel costs are a major expense for airlines, and fluctuations in oil prices can significantly impact their profitability. Higher fuel prices can lead to increased operating costs, while lower fuel prices can boost the airline's bottom line.

Regulatory Changes: The airline industry is heavily regulated, and any changes in regulations can have a profound effect on the stock market. For instance, the implementation of new safety regulations or antitrust laws can either increase or decrease the airline's operating costs.

Competition: The airline industry is highly competitive, with several major players such as Delta, United, and Southwest Airlines. Increased competition can lead to lower profit margins and a decline in the stock price.

Mergers and Acquisitions: The merger of US Airways with American Airlines was a significant event in the stock market. Such consolidations can lead to synergies and improved financial performance, which can positively impact the stock price.

Current Performance: In recent years, the US Airways stock market has shown a mixed performance. The stock price experienced a significant increase after the merger with American Airlines, reflecting the optimism surrounding the new entity. However, the stock has faced challenges due to economic factors and increased competition.

One of the key drivers of the stock's performance has been the airline's ability to reduce costs and improve efficiency. For instance, the merger with American Airlines has led to a reduction in the number of flights, resulting in lower operating costs. Additionally, the airline has implemented various cost-saving measures, such as optimizing aircraft utilization and improving labor agreements.

Case Study: US Airways vs. American Airlines

After the merger, the combined entity, American Airlines Group (AAG), has outperformed its competitors in terms of revenue and profitability. In 2017, AAG reported a net income of

Conclusion: The US Airways stock market has been influenced by a variety of factors, including economic conditions, fuel prices, regulatory changes, competition, and mergers and acquisitions. While the stock has experienced some volatility, the airline's recent performance indicates a positive outlook. Investors should closely monitor these factors to make informed decisions regarding their investments in the US Airways stock market.