Introduction: The recent conflict in Israel has once again highlighted the interconnectedness of global markets. As tensions rise, investors are increasingly concerned about the potential impact on the US stock market. This article delves into the potential effects of the Israel war on the US stock market, analyzing historical data and current market trends.

Understanding the Situation:

The ongoing conflict in Israel has raised concerns about geopolitical instability, which can have a significant impact on global markets. The US stock market, being one of the largest and most influential in the world, is particularly susceptible to such events.

Historical Context:

Historically, conflicts in the Middle East have had a notable impact on the US stock market. For instance, the Gulf War in 1990-1991 led to a sharp decline in the stock market, with the S&P 500 falling by nearly 20%. Similarly, the Iraq War in 2003 also resulted in a temporary decline in the market.

Current Market Trends:

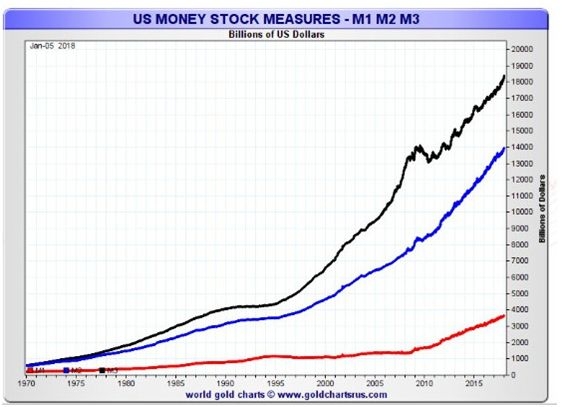

The current situation in Israel has already led to a rise in oil prices, which can have a direct impact on the US stock market. As the world's largest consumer of oil, any increase in prices can lead to higher inflation and reduced consumer spending, negatively affecting corporate earnings.

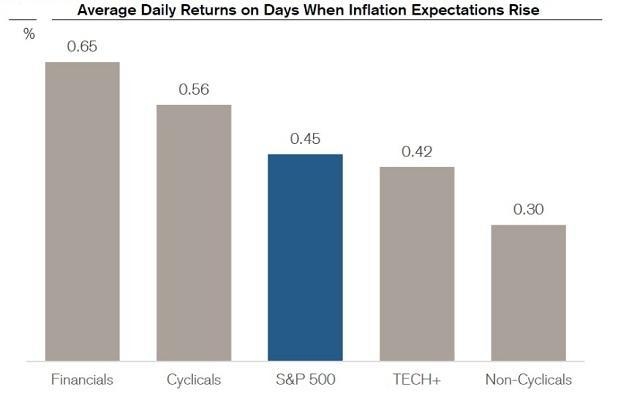

Sector-Specific Impacts:

The conflict in Israel has the potential to impact various sectors of the US stock market. Here are some key sectors to watch:

- Energy Sector: As mentioned earlier, rising oil prices can have a significant impact on the energy sector. Companies in this sector may see increased revenue due to higher prices, but they may also face increased costs due to geopolitical risks.

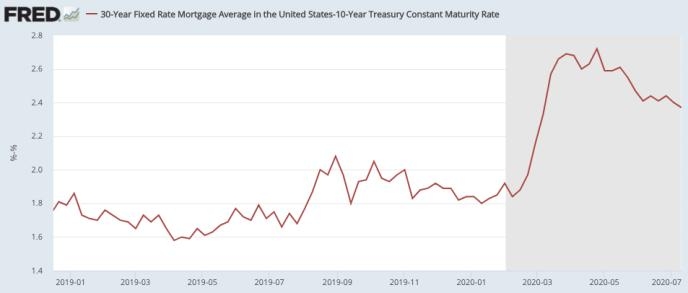

- Financial Sector: The financial sector may be affected by increased geopolitical risk premiums, leading to higher borrowing costs for consumers and businesses.

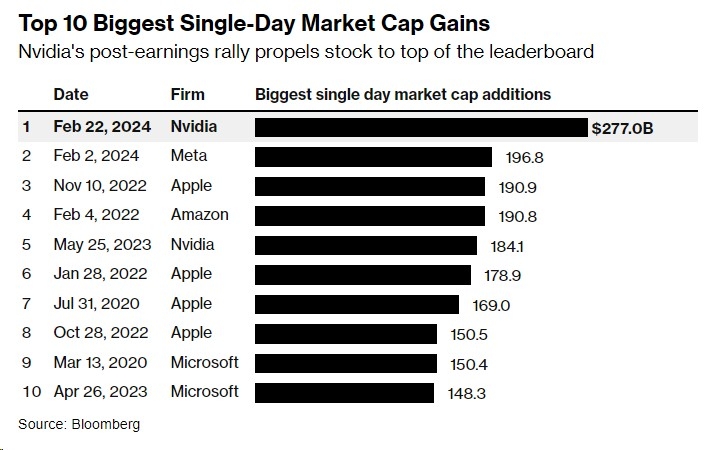

- Technology Sector: The technology sector may be affected by supply chain disruptions due to the conflict. Companies that rely on Israeli technology may see increased costs or delays in production.

Case Studies:

- Apple Inc. (AAPL): Apple has a significant presence in Israel, with a research and development center in the country. Any disruption in operations could lead to delays in product development and increased costs.

- Intel Corporation (INTC): Intel has a manufacturing facility in Israel, which could be affected by the conflict. Any disruption in production could lead to increased costs and delays in product availability.

Conclusion:

The Israel war has the potential to impact the US stock market in several ways. Investors should be aware of the risks and consider diversifying their portfolios accordingly. As always, it's important to stay informed and consult with a financial advisor before making any investment decisions.