The recent China-US trade talks have been a hot topic in the financial world, and for good reason. These negotiations have the potential to significantly impact the global economy, particularly in the realm of stock futures. This article delves into the implications of these trade talks for stock futures, offering insights and analysis.

China-US Trade Talks: The Background

The trade tensions between the United States and China have been escalating for several years. In early 2020, the two nations engaged in a series of negotiations aimed at resolving these disputes. However, progress has been slow, and there are still many unresolved issues.

The Impact on Stock Futures

The outcome of these trade talks has a direct impact on stock futures, particularly in sectors that are heavily reliant on trade with China. Here are some key areas to consider:

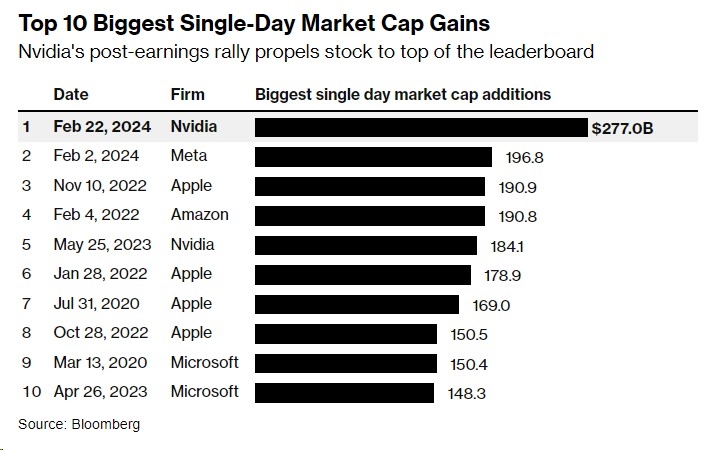

- Technology Stocks: The technology sector has been particularly affected by the trade tensions. Companies like Apple and Microsoft have manufacturing facilities in China, and any disruption in trade could impact their supply chains and profitability. As a result, stock futures in the technology sector have been volatile.

- Automotive Stocks: The automotive industry is another sector that is heavily reliant on trade with China. Many automakers have manufacturing plants in China, and any disruption in trade could impact their operations. As a result, stock futures in the automotive sector have also been volatile.

- Consumer Goods Stocks: The consumer goods sector is also vulnerable to trade tensions. Many consumer goods companies source raw materials and components from China, and any disruption in trade could impact their supply chains and profitability. As a result, stock futures in the consumer goods sector have been volatile as well.

Case Studies

Let's take a look at a couple of case studies to illustrate the impact of trade tensions on stock futures:

- Apple: In 2019, Apple faced increased tariffs on its products sold in the United States. This led to a decline in its stock price, and stock futures in the technology sector also fell. However, once the trade tensions began to ease, Apple's stock price and stock futures in the technology sector recovered.

- General Motors: In 2018, General Motors announced plans to shut down its plants in China due to trade tensions. This led to a decline in its stock price, and stock futures in the automotive sector also fell. However, once the trade tensions began to ease, General Motors' stock price and stock futures in the automotive sector recovered.

Conclusion

The China-US trade talks have a significant impact on stock futures, particularly in sectors that are heavily reliant on trade with China. Investors need to stay informed about the progress of these negotiations and be prepared for potential volatility in stock futures. While the outcome of these talks remains uncertain, one thing is clear: the global economy is closely watching these negotiations and their potential impact on trade and investment.