Are you looking to diversify your investment portfolio while minimizing taxes? Consider placing your US stocks in a Tax-Free Savings Account (TFSA). A TFSA is an excellent tool for long-term growth and tax-efficient investment in the United States. In this article, we will explore the benefits of putting US stocks in a TFSA and provide tips on how to do it effectively.

Understanding the TFSA

Firstly, let's clarify what a TFSA is. A TFSA is a registered account that allows you to contribute after-tax dollars, grow your investments tax-free, and withdraw the money tax-free when you need it. The annual contribution limit is adjusted each year and as of 2023, it stands at $6,000. Any unused contribution room can be carried forward indefinitely.

Why Put US Stocks in a TFSA?

1. Tax-Free Growth: One of the most significant advantages of placing US stocks in a TFSA is the tax-free growth. Unlike traditional RRSPs (Registered Retirement Savings Plans) or non-registered accounts, you won't have to pay taxes on the investment gains when you withdraw the money from your TFSA.

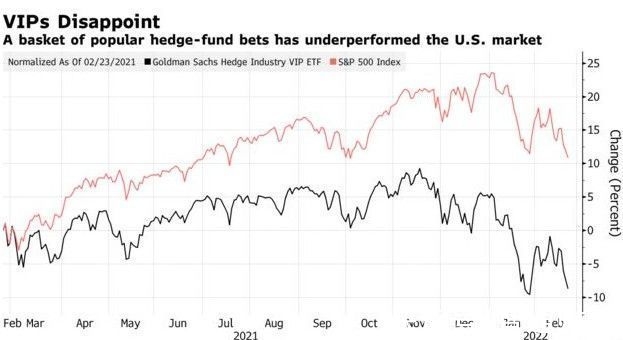

2. Diversification: Investing in US stocks can provide diversification to your portfolio, as the US market is often considered one of the largest and most robust in the world. This can help mitigate risks associated with investing in just one country's stock market.

3. No Capital Gains Tax: When you sell US stocks within your TFSA, you won't have to pay capital gains tax. This can be particularly beneficial if you plan to hold the stocks for the long term and expect significant gains.

How to Put US Stocks in a TFSA

To put US stocks in a TFSA, you need to follow these steps:

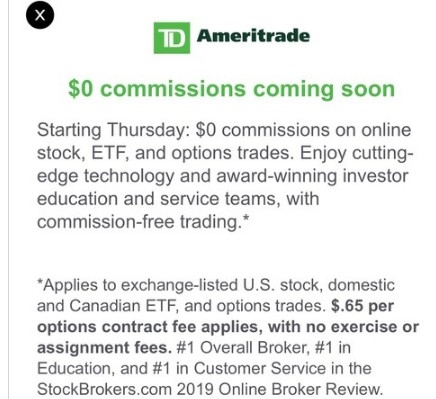

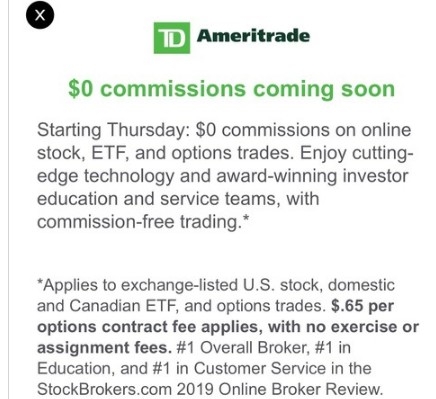

Open a TFSA: If you don't already have a TFSA, you'll need to open one. You can do this through a bank, credit union, or online brokerage firm.

Fund Your TFSA: Once you have your TFSA, you can transfer money into it from your bank account or other registered accounts.

Transfer US Stocks: If you already own US stocks, you can transfer them to your TFSA. Most brokerage firms allow you to do this directly. Alternatively, you can sell the stocks outside of your TFSA, reinvest the proceeds into your TFSA, and then buy the US stocks again within the TFSA.

Monitor Your TFSA: It's important to monitor your investments and ensure they align with your financial goals. Consider regularly reviewing your portfolio and making adjustments as needed.

Case Study:

Let's consider an example of a TFSA investment in US stocks. John invested

Conclusion

Putting US stocks in a TFSA is a smart investment strategy that can provide tax-free growth, diversification, and no capital gains tax. By following the steps outlined in this article, you can take advantage of this excellent investment opportunity. Remember to monitor your investments and stay informed about the market to make informed decisions.