Are you considering investing in stocks and shares through an ISA (Individual Savings Account) and are worried about the tax implications? If so, you're not alone. Many investors are unaware of the complexities surrounding US tax when investing in international markets, including those through an ISA. This article aims to provide a comprehensive overview of the key aspects you need to consider.

What is an ISA?

Firstly, let's clarify what an ISA is. An ISA is a tax-efficient savings or investment account available in the UK. It allows individuals to save money or invest in a range of products, including stocks and shares, without paying any income tax on the interest, dividends, or capital gains generated from the investment.

Understanding US Tax Implications

When it comes to US tax, the key concern is the potential double taxation on earnings from your ISA investments. While ISAs offer tax advantages in the UK, they may be subject to tax in the US if the investments are held outside of a US-based account.

Double Taxation

Double taxation occurs when you are taxed on the same income or gains in two different countries. To prevent this, most countries have double tax treaties in place. These treaties ensure that only one country taxes a particular income or gain.

In the case of ISAs, the UK has double tax treaties with the US. This means that if you invest in a US stock or share through your ISA, you should not be taxed on those earnings by the US government. However, it's important to ensure that you have correctly reported your ISA investments to the IRS (Internal Revenue Service) when filing your US tax return.

Reporting Your ISA Investments

To comply with US tax regulations, you must report your ISA investments on your US tax return. This is typically done using Form 8938, which is used to report foreign financial assets.

It's important to note that reporting requirements may vary depending on the value of your investments. For example, if the total value of your foreign financial assets exceeds $50,000, you may be required to file Form 8938. Failure to comply with reporting requirements can result in penalties and interest.

Key Considerations When Investing in Stocks and Shares ISA

1. Tax-efficient Structure: One of the primary benefits of an ISA is its tax-efficient structure. By holding your investments within an ISA, you can benefit from the tax advantages without the potential double taxation issues mentioned earlier.

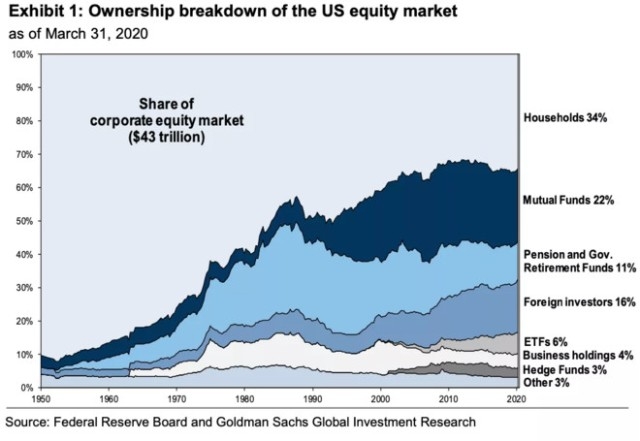

2. Diversification: Investing in stocks and shares through an ISA allows you to diversify your portfolio and potentially mitigate risk. By spreading your investments across various assets, sectors, and geographies, you can benefit from the overall performance of the market while reducing the impact of any single investment's performance.

3. Flexibility: An ISA provides you with the flexibility to invest in a range of stocks and shares, giving you the opportunity to align your investments with your financial goals and risk tolerance.

4. Long-term Growth: Investing in stocks and shares through an ISA can be a long-term strategy to build wealth and potentially generate substantial returns. However, it's important to understand that investments in stocks and shares carry inherent risks, and it's crucial to conduct thorough research and seek professional advice before making any investment decisions.

In conclusion, investing in stocks and shares through an ISA can be an attractive option for US investors looking to diversify their portfolio and benefit from tax-efficient savings. However, it's crucial to understand the potential US tax implications and ensure compliance with reporting requirements. By doing so, you can maximize your investment potential while minimizing the risk of penalties and interest.