In today's rapidly evolving technological landscape, semiconductor stocks have become a cornerstone of the US stock market. As a critical component in the production of electronics, semiconductors play a pivotal role in a wide array of industries, from consumer electronics to automotive and beyond. This article delves into the world of semiconductor stocks in the US, offering a comprehensive analysis of their performance, future potential, and the factors that influence their market dynamics.

Understanding Semiconductor Stocks

Before we dive into the details, it's essential to understand what semiconductor stocks are. Semiconductor stocks represent shares of companies that specialize in the design, development, and manufacturing of semiconductors. These companies are at the forefront of technological innovation, driving advancements in computing, communications, and other key sectors.

Performance of Semiconductor Stocks

Over the past few years, semiconductor stocks have exhibited impressive performance, often outpacing the broader market. This can be attributed to several factors, including the ever-increasing demand for advanced electronics and the growing importance of semiconductors in emerging technologies such as artificial intelligence, 5G, and the Internet of Things (IoT).

Key Players in the US Semiconductor Industry

Several key players have emerged as leaders in the US semiconductor industry. Companies like Intel, NVIDIA, and AMD have been at the forefront, consistently delivering strong financial results and driving innovation in the sector. Let's take a closer look at some of these companies:

- Intel: As one of the most established names in the industry, Intel has been a dominant force in the semiconductor market for decades. The company has a diverse portfolio of products, including microprocessors, memory, and other semiconductor devices.

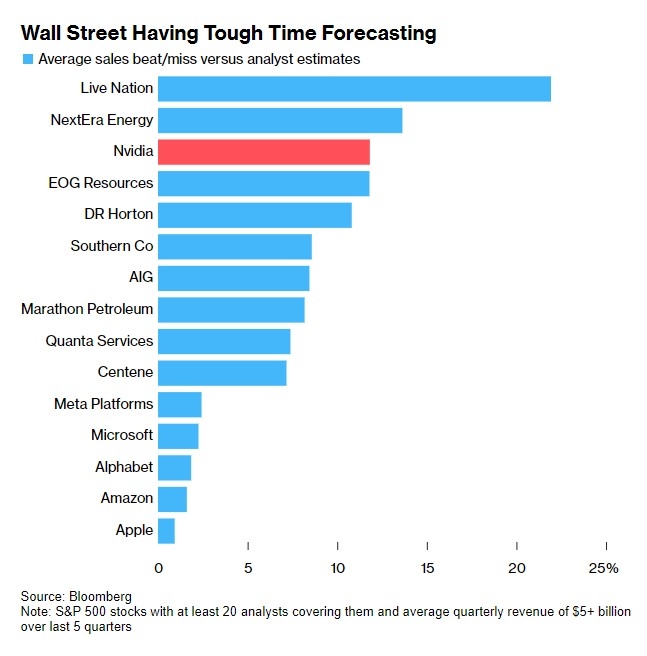

- NVIDIA: NVIDIA has gained significant traction in recent years, particularly due to its success in the graphics processing unit (GPU) market. The company's GPUs are widely used in gaming, artificial intelligence, and other high-performance computing applications.

- AMD: AMD has been making waves in the semiconductor industry, challenging Intel's dominance in the microprocessor market. The company's Ryzen processors have received positive reviews, and its growth trajectory has been impressive.

Factors Influencing Semiconductor Stocks

Several factors influence the performance of semiconductor stocks. These include:

- Global Supply Chain: The semiconductor industry is highly dependent on a global supply chain, which can be affected by various factors, such as trade tensions and geopolitical events.

- Technological Innovation: Continuous innovation is crucial for the growth of semiconductor stocks. Companies that can develop new technologies and capture market share will likely outperform their peers.

- Economic Conditions: Economic conditions, such as GDP growth and consumer spending, can have a significant impact on semiconductor demand and, consequently, stock prices.

Case Study: Intel's Acquisition of Mobileye

One notable case study in the US semiconductor industry is Intel's acquisition of Mobileye, a leading developer of autonomous driving technology. This deal underscores the importance of innovation and strategic partnerships in the sector. By acquiring Mobileye, Intel aims to strengthen its position in the autonomous driving market and capitalize on the growing demand for advanced driver-assistance systems (ADAS).

Conclusion

In conclusion, semiconductor stocks in the US have become a crucial component of the stock market, driven by the ever-increasing demand for advanced electronics and the growing importance of semiconductors in emerging technologies. As the industry continues to evolve, investors should stay informed about the key players, factors influencing stock performance, and emerging trends to make informed investment decisions.