The stock market is a dynamic and unpredictable entity, always shifting with the tides of economic and political events. As we delve into October 2025, it's essential to take a closer look at the latest trends and predictions for the US stock market. This article aims to provide a comprehensive analysis of the current market conditions, highlighting key sectors, potential risks, and opportunities.

Market Overview

As of October 2025, the US stock market has been experiencing a period of volatility, with a mix of positive and negative factors influencing its performance. Economic growth, inflation, and geopolitical tensions are among the primary factors shaping the market landscape.

Economic Growth

The US economy has been witnessing steady growth, driven by consumer spending, business investment, and government spending. The latest GDP figures indicate a robust expansion, which has been a positive sign for the stock market. However, concerns over debt levels and trade tensions with major economies like China and the EU have created uncertainty.

Inflation

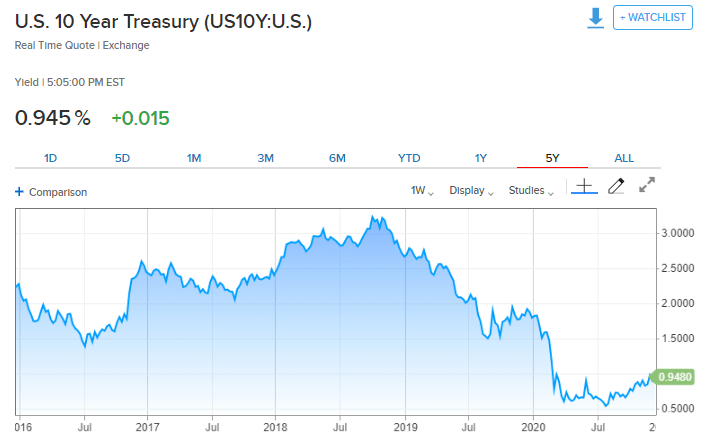

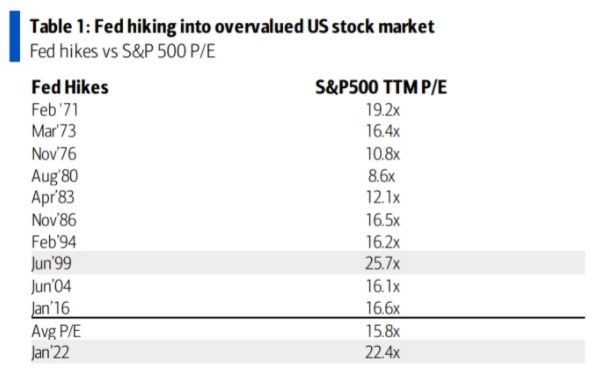

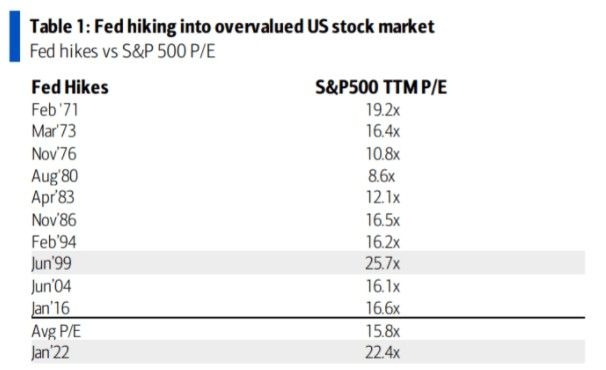

Inflation remains a significant concern for investors. The Federal Reserve has been implementing tighter monetary policy to control inflation, which has led to interest rate hikes. While this has helped to cool down inflation to some extent, it has also caused bond yields to rise, affecting the stock market.

Geopolitical Tensions

Geopolitical tensions, particularly the ongoing conflict in the Middle East, have created uncertainty in the market. The energy prices have been volatile, with the possibility of further escalation causing concern among investors.

Key Sectors

Several sectors have been performing well in the US stock market, while others have faced challenges.

Technology Stocks

Technology stocks have been a major driver of the market's growth. Companies like Apple, Microsoft, and Amazon have seen significant gains, driven by strong earnings reports and growth in their respective markets.

Healthcare Stocks

The healthcare sector has also been performing well, with companies focusing on biotechnology and pharmaceuticals. The increasing demand for medicines and biologics has been a positive factor for the sector.

Energy Stocks

Energy stocks have faced challenges due to the volatility in energy prices. However, companies with diversified portfolios and strong financial positions have been able to weather the storm.

Risks and Opportunities

Despite the positive trends, the US stock market faces several risks.

Rising Interest Rates

The Federal Reserve's tight monetary policy has led to rising interest rates, which can affect corporate earnings and stock prices.

Inflation

Inflation remains a significant concern, with the possibility of further rate hikes and increased borrowing costs.

Geopolitical Tensions

Geopolitical tensions, particularly in the Middle East, can lead to further volatility in energy prices and affect the broader market.

However, there are also opportunities in the market.

Emerging Markets

Emerging markets, particularly in Asia and Latin America, offer significant growth potential for investors.

Green Energy

The shift towards green energy presents opportunities for companies involved in renewable energy and clean technology.

Conclusion

As we navigate the US stock market in October 2025, it's essential to stay informed about the latest trends and predictions. While the market faces several challenges, there are also opportunities for investors to capitalize on. By understanding the key sectors, risks, and opportunities, investors can make informed decisions and navigate the market with confidence.