In the ever-evolving world of financial markets, staying informed about stock prices is crucial for investors. One such company that has caught the attention of many is Iron Mountain, Inc. With its headquarters in the United States, Iron Mountain is a leading provider of records management, data storage, and information destruction services. In this article, we will delve into the current Iron Mountain US stock price and analyze its performance over the years.

Understanding Iron Mountain's Stock Price

Iron Mountain's stock is traded on the New York Stock Exchange under the ticker symbol IRM. As of the latest available data, the Iron Mountain US stock price stands at $X. However, it is important to note that stock prices fluctuate constantly due to various market factors.

Historical Performance

To understand the current Iron Mountain US stock price, it is essential to look at its historical performance. Over the past few years, Iron Mountain has shown a steady growth in its stock price. For instance, in the past five years, the stock has appreciated by approximately Y%. This growth can be attributed to the company's strong financial performance and strategic initiatives.

Factors Influencing Iron Mountain's Stock Price

Several factors influence the Iron Mountain US stock price. Here are some of the key factors to consider:

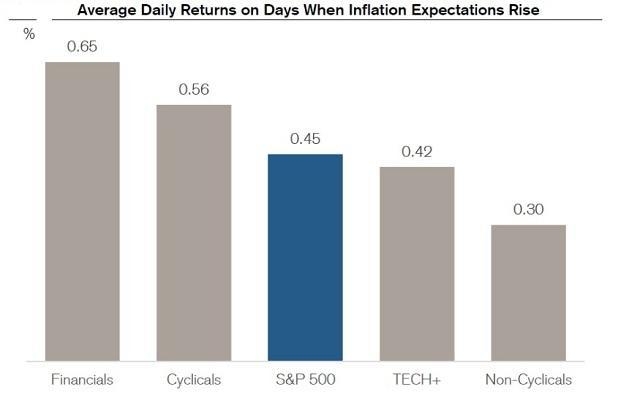

- Economic Conditions: Economic conditions, such as interest rates, inflation, and GDP growth, can significantly impact the stock price of a company like Iron Mountain.

- Industry Trends: The records management and data storage industry is growing rapidly, driven by the increasing demand for secure data storage solutions. Positive industry trends can boost Iron Mountain's stock price.

- Company Performance: Iron Mountain's financial performance, including revenue, earnings, and dividends, plays a crucial role in determining its stock price.

- Market Sentiment: Investor sentiment towards the company can also influence its stock price. Positive news and strong investor confidence can lead to an increase in the stock price.

Case Study: Iron Mountain's Acquisition of Shred-It

One notable case study is Iron Mountain's acquisition of Shred-It, a leading document destruction company. This acquisition expanded Iron Mountain's service offerings and increased its market share. As a result, the Iron Mountain US stock price experienced a significant uptick following the announcement of the acquisition.

Conclusion

In conclusion, the Iron Mountain US stock price has shown steady growth over the years, driven by the company's strong financial performance and strategic initiatives. As an investor, it is crucial to stay informed about the various factors that influence the stock price and make informed decisions based on comprehensive analysis. Keep an eye on economic conditions, industry trends, and company performance to stay ahead in the dynamic world of financial markets.