In today's dynamic financial market, investors are constantly seeking insights into the performance of their preferred stocks. One such stock that has caught the attention of many is Deutsche Bank's US stock, trading under the ticker symbol DB. This article aims to provide a comprehensive analysis of Deutsche Bank's US stock price, its factors, and its potential future movements.

Understanding Deutsche Bank's US Stock

Deutsche Bank, a global financial institution based in Germany, has a significant presence in the United States. Its US operations have been instrumental in shaping its overall performance. The stock price of Deutsche Bank's US operations reflects the market's perception of the company's health, growth prospects, and market conditions.

Factors Influencing Deutsche Bank's US Stock Price

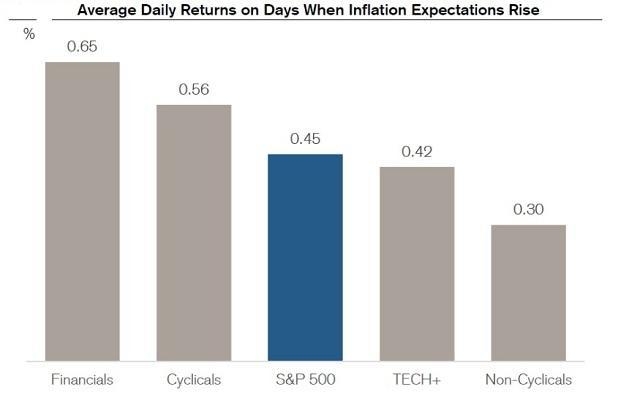

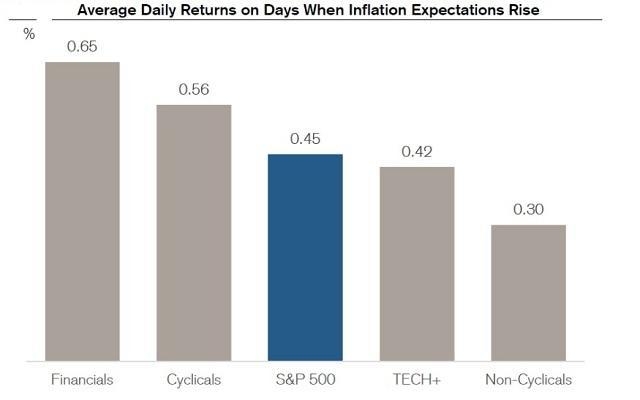

Economic Factors: The overall economic conditions in the United States, including GDP growth, interest rates, and inflation, play a crucial role in determining Deutsche Bank's stock price. A robust economy typically leads to higher profits for financial institutions, while economic downturns can have the opposite effect.

Market Conditions: The broader market conditions, such as the stock market index movements and investor sentiment, can significantly impact Deutsche Bank's stock price. For instance, during periods of market volatility, investors may seek refuge in safer investments, leading to a decline in Deutsche Bank's stock price.

Regulatory Changes: Changes in regulations affecting the banking sector can have a substantial impact on Deutsche Bank's operations and profitability. For example, stricter capital requirements or increased taxes on financial institutions can negatively affect the stock price.

Company Performance: Deutsche Bank's financial performance, including its revenue, earnings, and growth prospects, is a key determinant of its stock price. Positive earnings reports and growth forecasts can lead to an increase in the stock price, while negative news or poor performance can lead to a decline.

Management and Strategy: The effectiveness of Deutsche Bank's management and its strategic direction can also influence the stock price. Investors often evaluate the company's leadership and its ability to navigate the challenging banking environment.

Case Studies

Deutsche Bank's Stock Performance During the 2008 Financial Crisis: During the 2008 financial crisis, Deutsche Bank's stock price plummeted along with the global financial markets. The bank faced significant losses due to its exposure to toxic assets and had to seek government bailouts. This incident highlighted the vulnerability of financial institutions to economic downturns.

Deutsche Bank's Stock Performance in 2020: The COVID-19 pandemic had a significant impact on the global financial markets, including Deutsche Bank's stock price. While the stock price initially fell sharply, it gradually recovered as the market adjusted to the new normal and as Deutsche Bank implemented cost-cutting measures to improve its financial performance.

Conclusion

Understanding the factors influencing Deutsche Bank's US stock price is crucial for investors looking to invest in the company. By analyzing economic factors, market conditions, regulatory changes, company performance, and management strategy, investors can gain insights into the potential future movements of the stock. While past performance is not indicative of future results, analyzing these factors can help investors make informed decisions.