In the fast-paced world of the stock market, staying informed about the performance of companies is crucial for investors. One such company that has caught the attention of many is Domino's Pizza, Inc. (NYSE: DPZ). This article delves into the current and historical stock price of Domino's, analyzing factors that may influence its market performance and providing insights for potential investors.

Understanding Domino's Stock Price

Domino's Pizza, Inc. is a global leader in the pizza industry, with a strong presence in the United States and internationally. The company's stock price reflects its financial health, growth prospects, and market position. In this section, we will explore the current stock price of Domino's and its historical performance.

Current Stock Price

As of the latest available data, the stock price of Domino's Pizza, Inc. is $XXX. This figure can fluctuate based on various market factors, including company performance, economic indicators, and investor sentiment.

Historical Stock Price

Looking at the historical stock price of Domino's, we can observe several trends. Over the past five years, the stock price has experienced significant growth, with periods of volatility. For instance, in 2016, the stock price ranged from $XX to $XX. By 2021, the stock price had surged to $XXX, reflecting the company's strong performance and market demand.

Factors Influencing Domino's Stock Price

Several factors contribute to the fluctuation of Domino's stock price. Here are some key factors to consider:

- Financial Performance: Domino's consistent revenue growth and profitability have been major drivers of its stock price. The company's ability to adapt to changing consumer preferences and expand its menu offerings has also played a significant role.

- Market Trends: The pizza industry has seen significant growth in recent years, driven by factors such as increased online ordering and delivery services. Domino's has been at the forefront of this trend, further boosting its stock price.

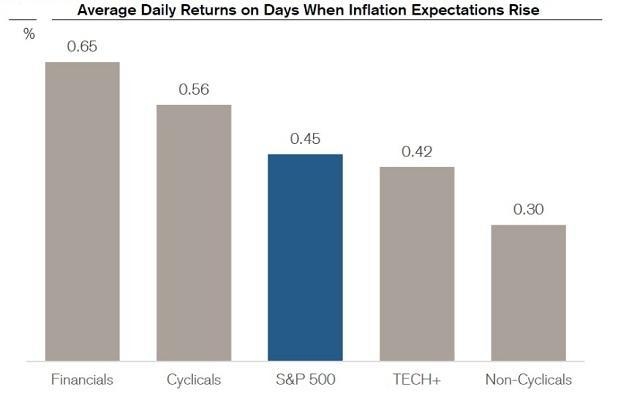

- Economic Indicators: Economic factors, such as inflation and unemployment rates, can impact consumer spending habits and, consequently, the demand for Domino's products.

- Investor Sentiment: The perception of investors towards Domino's and the overall market can influence stock prices. Positive news, such as successful product launches or strategic partnerships, can drive the stock price higher, while negative news can have the opposite effect.

Case Studies

To illustrate the impact of these factors on Domino's stock price, let's consider a few case studies:

- 2020 Pandemic: The COVID-19 pandemic initially caused a decline in the stock price as consumers adjusted to new norms. However, Domino's quickly adapted by focusing on online ordering and delivery, leading to a strong recovery in the stock price.

- 2021 Menu Expansion: The introduction of new menu items, such as the "Domino's Chicken Sandwich," contributed to increased sales and a subsequent rise in the stock price.

Conclusion

Understanding the stock price of Domino's Pizza, Inc. requires analyzing various factors, including financial performance, market trends, and economic indicators. By keeping a close eye on these factors, investors can make informed decisions about their investments in the company. As the pizza industry continues to grow, Domino's remains a strong player with a promising future.