The US stock market has been a cornerstone of global financial markets, but recently, it has experienced a downturn. Investors are left scratching their heads, wondering why the market is down. In this article, we'll explore the reasons behind the recent decline in the US stock market.

Economic Factors

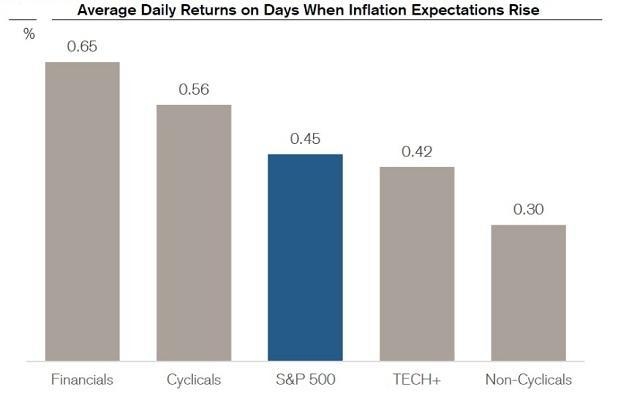

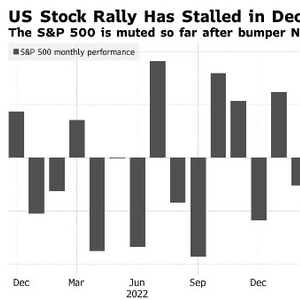

One of the primary reasons for the US stock market's downturn is economic factors. The Federal Reserve has been raising interest rates to combat inflation, which has been a persistent issue in the economy. As interest rates rise, borrowing costs increase, which can lead to a slowdown in economic growth. This has a direct impact on the stock market, as higher borrowing costs can lead to reduced corporate profits and investment.

Global Economic Concerns

The US stock market is not immune to global economic concerns. The ongoing trade tensions between the US and China, along with economic uncertainties in Europe and other parts of the world, have contributed to the market's decline. These global issues can lead to a decrease in consumer confidence, which in turn can impact stock prices.

Technological Stocks

The technology sector has been a significant driver of the US stock market's growth over the past few years. However, recent declines in the tech sector have had a significant impact on the overall market. Issues such as regulatory scrutiny, increased competition, and concerns about the sustainability of growth have contributed to the downturn in tech stocks.

Corporation Earnings

Another factor contributing to the stock market's decline is the decrease in corporate earnings. Many companies have reported lower-than-expected earnings, which has led to a decrease in investor confidence. When companies do not meet their earnings forecasts, it can lead to a sell-off in their stocks, further contributing to the market's downturn.

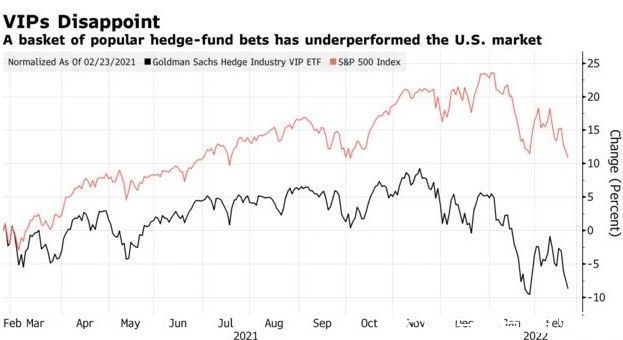

Investor Sentiment

Investor sentiment plays a crucial role in the stock market. When investors are optimistic, they are more likely to invest in the market, leading to higher stock prices. Conversely, when investors are pessimistic, they are more likely to sell their stocks, leading to lower prices. The recent downturn in the US stock market can be attributed, in part, to a shift in investor sentiment from optimism to pessimism.

Case Studies

One example of the impact of economic factors on the stock market is the tech giant Apple. Apple's stock has been on a downward trend, partly due to concerns about global economic conditions and increased competition. Another example is the decline in the stock of Tesla, which has been affected by regulatory scrutiny and concerns about the company's growth prospects.

In conclusion, the US stock market's downturn can be attributed to a combination of economic factors, global concerns, technological issues, and investor sentiment. While the market may continue to face challenges, understanding these factors can help investors make informed decisions.