Understanding the Possibility

Are you a Canadian expat dreaming of investing in the U.S. stock market? The question on your mind is, "Can I buy US stocks while living in Canada?" The answer is a resounding yes, and in this article, we will explore how you can do so seamlessly.

Understanding the Basics

Before diving into the details, it's essential to understand the basics. The U.S. stock market is one of the most robust and liquid in the world, offering a wide array of investment opportunities. On the other hand, Canada has its stock market, which is also quite strong, but it might not offer the same level of diversity as the U.S.

Opening a Brokerage Account

To buy U.S. stocks while living in Canada, you need to open a brokerage account with a U.S.-based brokerage firm. There are several reputable brokers that cater to international clients, such as TD Ameritrade, E*TRADE, and Charles Schwab.

When opening an account, you will need to provide your Canadian and U.S. tax information. It's important to note that you may be subject to U.S. tax on your investments, so it's advisable to consult a tax professional to ensure compliance.

Understanding the Risks

While investing in U.S. stocks offers numerous benefits, it's crucial to understand the risks involved. The U.S. stock market can be volatile, and it's essential to research and understand the companies you're investing in. Additionally, currency exchange rates can impact your returns, so it's important to keep an eye on the CAD/USD exchange rate.

Tax Implications

As mentioned earlier, you may be subject to U.S. tax on your investments. However, Canada has a tax treaty with the United States that can help mitigate some of these tax implications. It's important to consult with a tax professional to understand the specific tax implications of investing in U.S. stocks while living in Canada.

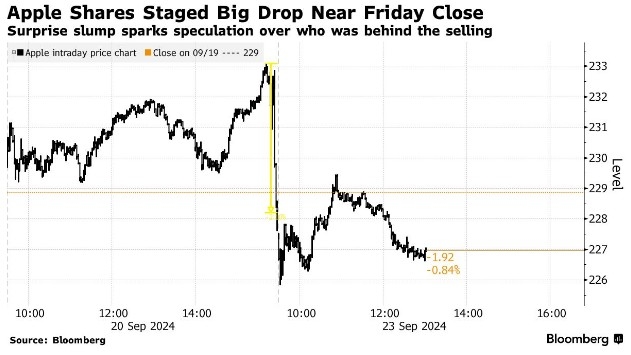

Case Study: Investing in Apple (AAPL) from Canada

Let's consider a hypothetical scenario. Suppose you decide to invest in Apple (AAPL), one of the most popular and successful companies in the world. To do so, you would open a brokerage account with a U.S.-based broker, deposit funds in U.S. dollars, and place an order to buy shares of Apple.

If you're invested in Apple for a year, you'll receive dividends in U.S. dollars, which will be subject to U.S. tax. However, under the Canada-U.S. tax treaty, you may be eligible for a credit on your Canadian taxes for the U.S. tax paid on the dividends.

Conclusion

In conclusion, buying U.S. stocks while living in Canada is indeed possible. By opening a brokerage account with a U.S.-based broker, you can invest in a wide array of U.S. stocks. However, it's important to understand the risks and tax implications involved. Consulting with a tax professional can help ensure compliance and maximize your investment returns.