In today's fast-paced global market, investing in the right stocks can be a game-changer for your portfolio. One such opportunity that has been making waves is the prospect of buying Huawei stock in the US. Huawei, a leading global provider of information and communications technology (ICT) infrastructure and smart devices, has a strong presence in the tech industry. This article delves into why investing in Huawei stock could be a smart move for investors looking to diversify their portfolios.

Understanding Huawei's Market Position

Huawei is a powerhouse in the tech industry, with a diverse range of products and services that cater to various segments of the market. From smartphones and networking equipment to cloud computing and AI solutions, Huawei has a robust product portfolio that continues to expand. The company's market position is further strengthened by its strong R&D capabilities and strategic partnerships with key industry players.

The US Market Potential

Investing in Huawei stock in the US presents a unique opportunity to tap into the growing demand for cutting-edge technology. The US market is one of the largest and most dynamic in the world, with a consumer base that is always on the lookout for the latest tech innovations. By investing in Huawei, you are essentially placing a bet on the company's ability to capture a significant share of this market.

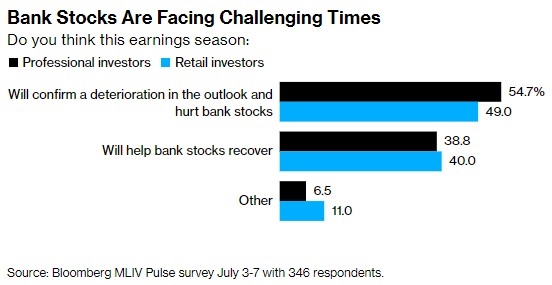

Huawei's Financial Performance

One of the key reasons to consider buying Huawei stock is the company's impressive financial performance. Despite facing challenges in certain markets, Huawei has managed to maintain strong revenue growth and profitability. The company's financial statements reflect a solid balance sheet and a commitment to innovation, making it an attractive investment opportunity.

Huawei's Growth Strategy

Huawei has a clear growth strategy that focuses on expanding its presence in key markets and diversifying its product portfolio. The company is investing heavily in research and development to stay ahead of the competition and meet the evolving needs of its customers. This strategic approach has helped Huawei establish itself as a leader in the tech industry and positions it well for future growth.

Case Study: Huawei's Success in the US

A prime example of Huawei's success in the US is its partnership with AT&T. In 2017, Huawei and AT&T announced a collaboration to develop 5G technology, marking a significant milestone for the company in the US market. This partnership not only highlights Huawei's technical expertise but also demonstrates its commitment to innovation and collaboration.

Why Buy Huawei Stock Now?

The current market conditions present a favorable opportunity to buy Huawei stock. With the global tech industry experiencing rapid growth, investing in a company like Huawei can offer significant returns. Additionally, the company's focus on innovation and expansion into new markets makes it a compelling investment choice.

Conclusion

In conclusion, buying Huawei stock in the US is a smart investment opportunity for those looking to diversify their portfolios. With a strong market position, impressive financial performance, and a clear growth strategy, Huawei is well-positioned to capitalize on the growing demand for technology in the US market. As an investor, it's important to conduct thorough research and consider the potential risks and rewards before making any investment decisions. However, with Huawei's track record and future prospects, it's a compelling option worth considering.