In today's fast-paced financial market, keeping a close eye on stock prices is crucial for investors. One such stock that has been garnering attention is APE.US. In this article, we will delve into the APE.US stock price, exploring its trends, factors influencing it, and providing insights for potential investors.

Understanding APE.US

Before we dive into the stock price, it's essential to have a basic understanding of APE.US. APE.US is the ticker symbol for a company that operates in the technology sector. The company is known for its innovative products and services, which have contributed to its steady growth and popularity among investors.

Recent Trends in APE.US Stock Price

In the past few months, the APE.US stock price has shown a significant upward trend. This upward momentum can be attributed to several factors, including strong financial performance, positive market sentiment, and increased investor confidence.

Factors Influencing APE.US Stock Price

Financial Performance: One of the primary factors that influence the APE.US stock price is the company's financial performance. A strong revenue growth, improved profit margins, and positive earnings reports can boost the stock price.

Market Sentiment: The overall market sentiment plays a crucial role in determining the stock price. When the market is bullish, investors tend to buy more stocks, leading to an increase in stock prices.

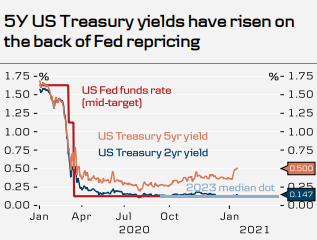

Economic Factors: Economic factors, such as interest rates, inflation, and economic growth, can also impact the APE.US stock price. For instance, a decrease in interest rates can lead to increased borrowing and investment, which may positively affect the stock price.

Industry Trends: The technology industry, in which APE.US operates, is constantly evolving. Keeping up with the latest industry trends and innovations can provide valuable insights into the company's future prospects and, consequently, its stock price.

Case Studies

To illustrate the impact of these factors on the APE.US stock price, let's consider a few case studies:

Financial Performance: In the last quarter, APE.US reported a revenue growth of 20% and a profit margin of 15%. This strong financial performance led to a surge in the stock price, as investors were optimistic about the company's future prospects.

Market Sentiment: During a period of positive market sentiment, the APE.US stock price experienced a significant increase. This was due to the general optimism in the market, which made investors more willing to invest in stocks, including APE.US.

Economic Factors: A decrease in interest rates led to increased borrowing and investment in the technology sector, including APE.US. This resulted in a rise in the stock price as investors were attracted to the sector's growth potential.

Industry Trends: The launch of a new innovative product by APE.US, which received widespread acclaim, contributed to a surge in the stock price. Investors were excited about the company's ability to stay ahead of industry trends and innovate continuously.

Conclusion

The APE.US stock price has been on an upward trend in recent months, driven by various factors, including strong financial performance, positive market sentiment, and economic factors. As an investor, it's crucial to stay informed about these factors and consider them while making investment decisions. By keeping a close eye on the APE.US stock price and understanding the factors influencing it, investors can make more informed decisions and potentially capitalize on the company's growth prospects.