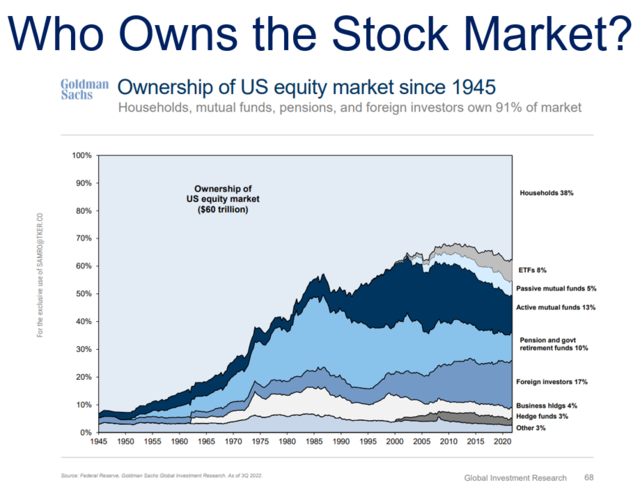

In today's globalized world, the opportunity to invest in stocks outside of the United States has become increasingly accessible. As a U.S. citizen, you may be considering buying stocks in another country to diversify your portfolio or capitalize on international market trends. This comprehensive guide will walk you through the process, highlighting key considerations and potential benefits.

Understanding the Basics

Before diving into the specifics, it's important to understand the basics of buying stocks in another country. When you purchase stocks from a foreign company, you become a shareholder in that company, entitling you to a portion of its profits. However, investing in foreign stocks comes with its own set of challenges and risks.

Research and Due Diligence

One of the most crucial steps in buying stocks in another country is thorough research and due diligence. This involves:

- Understanding the foreign market: Familiarize yourself with the country's economic, political, and social landscape. This will help you assess the stability and potential growth of the market.

- Analyzing the company: Evaluate the financial health, management team, and competitive position of the company you're considering investing in.

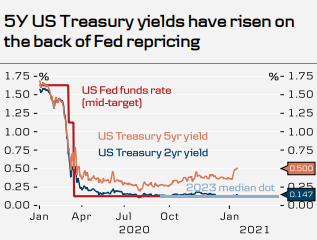

- Currency risk: Be aware of the potential impact of currency fluctuations on your investment.

Opening an Account

To buy stocks in another country, you'll need to open a brokerage account that allows for international trading. Here are some key factors to consider when choosing a brokerage:

- Regulatory compliance: Ensure the brokerage is registered and regulated by the appropriate authorities in both the U.S. and the country where you're investing.

- Fees and commissions: Compare the fees and commissions charged by different brokers to find the most cost-effective option.

- Customer service: Look for a brokerage with reliable and responsive customer service.

Understanding Risks

Investing in foreign stocks carries its own set of risks, including:

- Political and economic instability: Changes in government, trade policies, and economic conditions can impact the performance of foreign stocks.

- Currency risk: Fluctuations in exchange rates can affect the value of your investment.

- Liquidity risk: Some foreign stocks may be less liquid, making it more difficult to buy or sell shares at a fair price.

Benefits of International Investing

Despite the risks, there are several compelling reasons to consider buying stocks in another country:

- Diversification: Investing in a variety of markets can help reduce your overall risk.

- Access to unique opportunities: Some foreign companies may offer unique products or services that are not available in the U.S.

- Potential for higher returns: Some foreign markets may offer higher growth rates than the U.S. market.

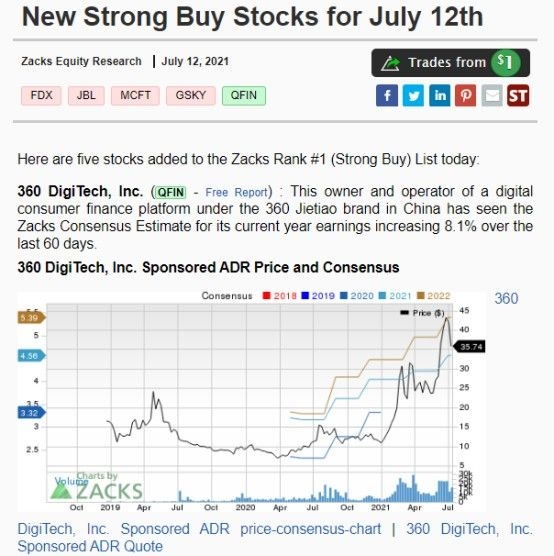

Case Study: Investing in Chinese Stocks

One popular example of international investing is in Chinese stocks. Here's a brief case study:

- Market overview: The Chinese stock market has experienced significant growth over the past decade, driven by factors such as urbanization and technological advancements.

- Key sectors: Key sectors in the Chinese market include technology, consumer goods, and healthcare.

- Example company: Tencent, a leading Chinese technology company, has seen strong growth and is considered a good investment opportunity.

Conclusion

Buying stocks in another country can be a rewarding way to diversify your portfolio and capitalize on international market trends. However, it's important to conduct thorough research, understand the risks, and choose the right brokerage. By doing so, you can make informed decisions and potentially benefit from the global investment landscape.