The United States stock market is one of the most influential and dynamic markets in the world. It's home to some of the most recognized and successful companies globally, and investors from around the world closely monitor its movements. The term "US stock market averages" refers to the collective performance of a selection of stocks that are considered to represent the broader market. In this article, we will delve into the significance of these averages, how they are calculated, and their impact on the market.

The Major Averages:

The most widely followed US stock market averages include the Dow Jones Industrial Average (DJIA), the S&P 500, and the NASDAQ Composite Index. Each of these averages provides a unique perspective on the overall health and performance of the market.

The Dow Jones Industrial Average is often referred to as the "blue chip" index because it consists of 30 large, well-established companies across various sectors. This index is a good indicator of the overall performance of the stock market and is often used as a benchmark for long-term investing strategies.

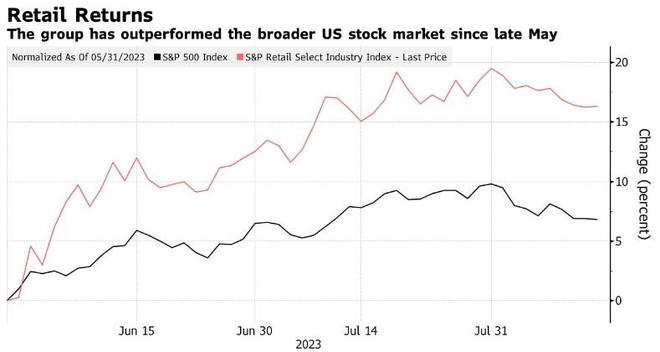

The S&P 500 is another significant average that tracks the performance of 500 large companies across the U.S. economy. It is considered a broader representation of the market and is often used to gauge the overall market's health and trends.

The NASDAQ Composite Index is unique because it focuses on technology companies, which have historically been some of the most innovative and fastest-growing companies in the market. This index provides insight into the performance of the tech sector and its impact on the broader market.

How Averages Are Calculated:

The calculation of these averages varies slightly, but they generally involve adding up the prices of the constituent stocks and dividing by a factor, such as the number of shares outstanding or the total market capitalization.

For example, the DJIA is calculated by adding the stock prices of its 30 components and dividing by a divisor, which is adjusted periodically to account for stock splits, dividends, and other corporate actions.

Impact on the Market:

US stock market averages have a significant impact on investors and the broader economy. Here are a few ways in which they influence the market:

Investor Sentiment: The performance of these averages can influence investor sentiment and market confidence. A rising average can indicate optimism and lead to increased investor participation, while a falling average can indicate pessimism and lead to a decrease in investment activity.

Economic Indicators: These averages are often used as economic indicators to gauge the overall health of the economy. For example, a rising S&P 500 can suggest economic growth, while a falling index can indicate economic contraction.

Policy Making: Policymakers closely monitor these averages to make informed decisions. For example, the Federal Reserve may adjust interest rates based on the perceived health of the stock market.

Case Study:

One notable case study is the tech bubble of the late 1990s and early 2000s. During this period, the NASDAQ Composite Index surged, driven by rapid growth in technology stocks. However, the bubble eventually burst, leading to a significant decline in the index and widespread losses for investors. This event highlighted the importance of understanding the broader market context when evaluating individual stocks.

In conclusion, US stock market averages are essential tools for investors and market analysts. They provide a comprehensive view of the market's performance and trends, helping investors make informed decisions and policymakers develop appropriate economic policies. By understanding the significance of these averages, investors can better navigate the complex world of the stock market.