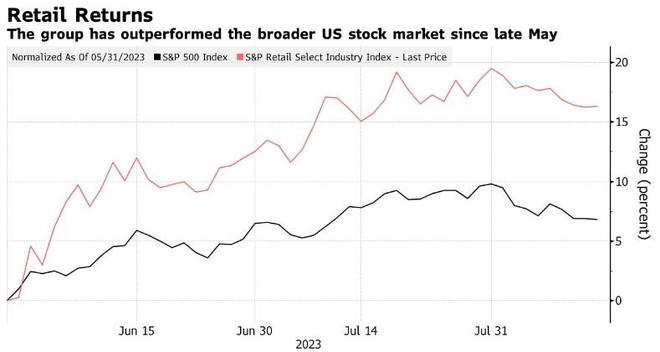

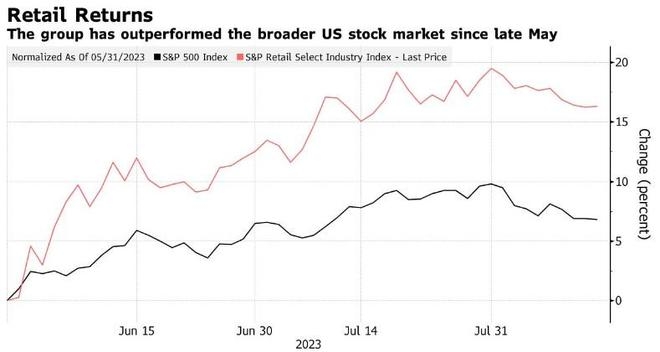

Introduction: In the dynamic world of the stock market, consumer discretionary stocks have always been a hot topic. These stocks represent companies that produce goods and services that consumers can choose to buy or not, depending on their disposable income. As the US economy continues to grow, investors are looking for the best consumer discretionary stocks to add to their portfolios. In this article, we will discuss the top consumer discretionary stocks in the US, their potential growth, and why they might be worth considering for your investment portfolio.

1. Amazon (AMZN): As the world's largest online retailer, Amazon has revolutionized the way people shop. With its vast product range and seamless customer experience, Amazon has become a staple in many consumers' lives. The company's impressive revenue growth and expanding product offerings make it a top pick for investors looking for consumer discretionary stocks.

2. Netflix (NFLX): Netflix has become a household name in the entertainment industry. The streaming giant offers a vast library of movies, TV shows, and documentaries, catering to a wide audience. With its strong subscriber base and continued expansion into new markets, Netflix is a top consumer discretionary stock to watch.

3. Disney (DIS): Disney, known for its iconic characters and family-friendly movies, has a strong presence in the entertainment industry. The company owns and operates popular streaming services like Disney+ and Hulu, as well as theme parks around the world. With its diverse revenue streams, Disney remains a top consumer discretionary stock to consider.

4. Home Depot (HD): Home Depot is a leading retailer of home improvement products and services in the US. The company has a vast network of stores and offers a wide range of products, from appliances to gardening supplies. As the housing market continues to grow, Home Depot remains a solid investment in the consumer discretionary sector.

5. Nike (NKE): Nike is a global leader in the sportswear industry, known for its high-quality products and innovative designs. The company has a strong brand presence and a loyal customer base, making it a top consumer discretionary stock. With its continuous expansion into new markets and product categories, Nike remains a compelling investment opportunity.

Case Study: Apple (AAPL) While Apple is not traditionally considered a consumer discretionary stock, its products fall under this category due to their high demand and discretionary nature. Apple's iPhone, iPad, and Mac products have become must-have items for many consumers. The company's strong financial performance and continuous innovation make it a top consumer discretionary stock to consider.

Conclusion: Investing in consumer discretionary stocks can be a great way to diversify your portfolio and capitalize on the growing US economy. By focusing on top consumer discretionary stocks like Amazon, Netflix, Disney, Home Depot, and Nike, investors can potentially benefit from strong revenue growth and increased consumer spending. Always remember to do thorough research and consult with a financial advisor before making any investment decisions.