The US30 Index, also known as the Dow Jones Industrial Average (DJIA), is one of the most widely followed stock market indices in the world. It represents the performance of 30 large companies listed on the New York Stock Exchange (NYSE) and the NASDAQ. In this article, we will delve into the history, components, and significance of the US30 Index, providing investors with a comprehensive guide to this crucial market indicator.

The History of the US30 Index

The US30 Index was first introduced by the Dow Jones & Company in 1896. It was created to provide a broad measure of the overall performance of the US stock market. Initially, the index included 12 companies, but it has since expanded to include 30 companies. Over the years, the US30 Index has become a benchmark for investors and traders around the globe.

Components of the US30 Index

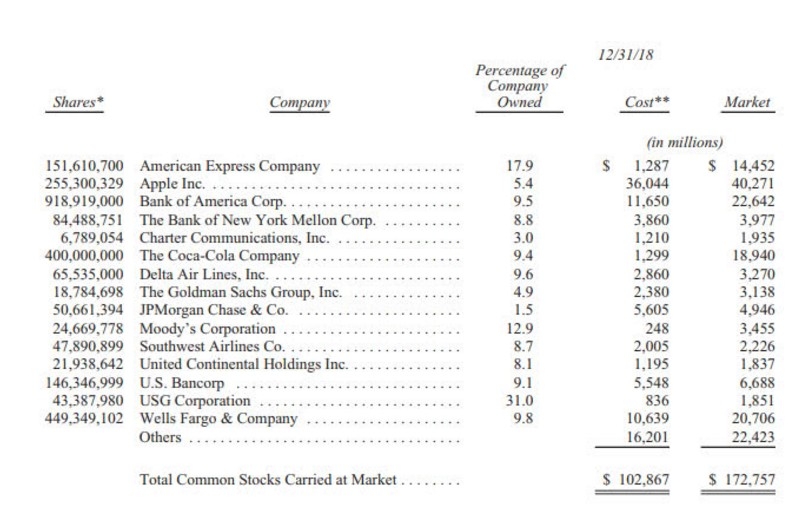

The US30 Index consists of 30 companies across various industries, including technology, finance, healthcare, and consumer goods. Some of the most well-known companies included in the index are Apple Inc., Microsoft Corporation, Visa Inc., and Johnson & Johnson. The components of the index are periodically reviewed and adjusted to reflect changes in the market and the performance of the individual companies.

Significance of the US30 Index

The US30 Index is considered one of the most significant stock market indices for several reasons:

Market Performance Indicator: The US30 Index provides a snapshot of the overall performance of the US stock market. By tracking the performance of the 30 largest companies, it offers a broad measure of market trends and economic conditions.

Investor Confidence: The US30 Index is often used as a gauge of investor confidence. When the index is rising, it generally indicates that investors are optimistic about the market, while a falling index may suggest pessimism.

Benchmark for Portfolios: The US30 Index is a popular benchmark for investors and fund managers. Many mutual funds and exchange-traded funds (ETFs) are designed to track the performance of the index, allowing investors to gain exposure to a diversified portfolio of large US companies.

How to Trade the US30 Index

Investors can trade the US30 Index through various means, including:

Futures Contracts: Futures contracts are financial derivatives that allow investors to speculate on the future price of an asset. Trading the US30 Index through futures contracts can provide exposure to the index without owning the underlying stocks.

ETFs: ETFs are exchange-traded funds that track the performance of a specific index. US30 Index ETFs allow investors to gain exposure to the index without the need to trade individual stocks.

Stock Options: Investors can also trade options on the US30 Index, which provide the right, but not the obligation, to buy or sell the index at a predetermined price within a specific timeframe.

Case Studies

Let's look at a couple of case studies to illustrate the importance of the US30 Index:

2008 Financial Crisis: During the 2008 financial crisis, the US30 Index experienced a significant decline. This decline reflected the broader market's reaction to the crisis and served as a warning sign for investors.

COVID-19 Pandemic: In 2020, the US30 Index faced another major challenge as the COVID-19 pandemic caused widespread economic uncertainty. Despite the initial decline, the index recovered quickly, reflecting the resilience of the US economy and the stock market.

In conclusion, the US30 Index is a crucial indicator of the US stock market's performance and investor sentiment. By understanding the index's history, components, and significance, investors can make informed decisions and gain exposure to the broader market.