In the fast-paced world of finance, predicting the future stock price of a company is a challenge that has captivated investors for decades. The allure of foresight in the stock market is undeniable, as it could potentially lead to substantial gains. This article delves into the various techniques and methodologies used to forecast future stock prices, offering insights into the art and science of market analysis.

Understanding the Variables

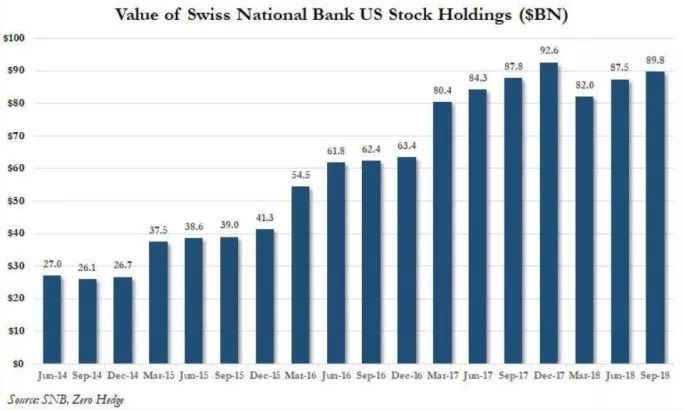

Predicting stock prices involves understanding a multitude of variables, including historical data, market trends, and fundamental analysis. Historical data, such as past stock prices and trading volumes, can provide valuable insights into the company's performance and market behavior. Market trends, on the other hand, consider broader economic factors, industry developments, and market sentiment.

Historical Price Analysis

One of the most popular methods for predicting future stock prices is historical price analysis. This technique involves studying past stock prices and identifying patterns, trends, and cycles. Traders and investors often use various technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), to make informed decisions.

Fundamental Analysis

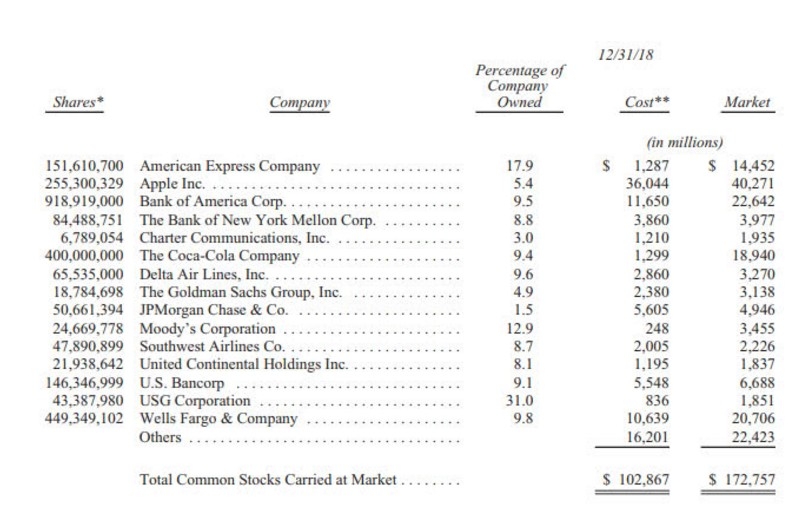

In addition to historical price analysis, fundamental analysis plays a crucial role in predicting future stock prices. This approach involves evaluating the financial health and prospects of a company. Key factors considered in fundamental analysis include the company's revenue, earnings, debt levels, and management team. By assessing these factors, investors can gain a deeper understanding of the company's intrinsic value.

Quantitative Models

Quantitative models, also known as predictive models, use mathematical algorithms to forecast future stock prices. These models can analyze vast amounts of data and identify patterns that may not be immediately apparent to the human eye. Common quantitative models include linear regression, time series analysis, and machine learning algorithms.

Case Study: Predicting Amazon's Stock Price

A prime example of a successful stock price prediction is Amazon's rise over the years. By analyzing historical price data and considering market trends, many investors were able to predict the company's growth trajectory. For instance, in 2001, Amazon's stock price was around

Challenges and Limitations

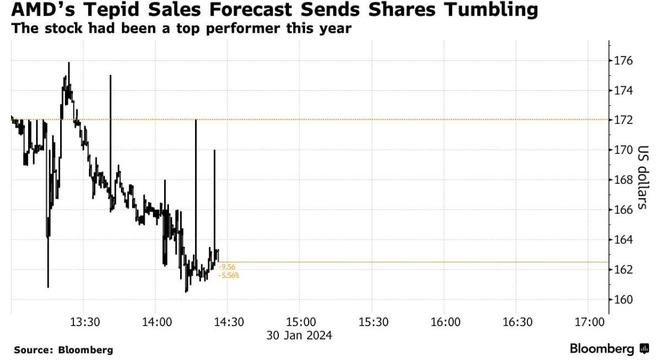

Despite the advancements in technology and analysis techniques, predicting future stock prices remains a challenging task. Market volatility, unexpected news, and unforeseen events can all impact stock prices. Moreover, the human element, including investor sentiment and psychological factors, can also influence market movements.

Conclusion

Predicting future stock prices is an intricate process that requires a combination of technical and fundamental analysis, along with the use of advanced quantitative models. While there is no foolproof method, understanding the variables and employing a holistic approach can increase the accuracy of predictions. As investors, it's essential to stay informed, adapt to changing market conditions, and make well-informed decisions based on a thorough analysis of the available data.