In today’s dynamic economic landscape, the interplay between the US economy, stocks, and real estate is a critical area of focus for investors and analysts alike. This article delves into the intricate relationship between these three sectors, offering insights into how they impact each other and provide opportunities for growth and investment.

The US Economy: A Vital Foundation

The US economy is often regarded as a benchmark for global economic health. With its diverse sectors, strong financial markets, and robust consumer spending, the US economy has historically been a driver of global economic activity. Understanding the current state of the US economy is essential for anyone looking to invest in stocks or real estate.

Stock Market Dynamics

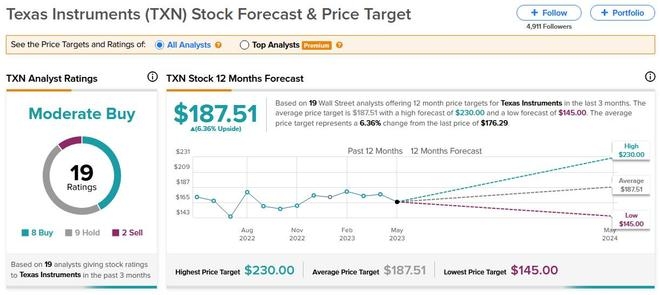

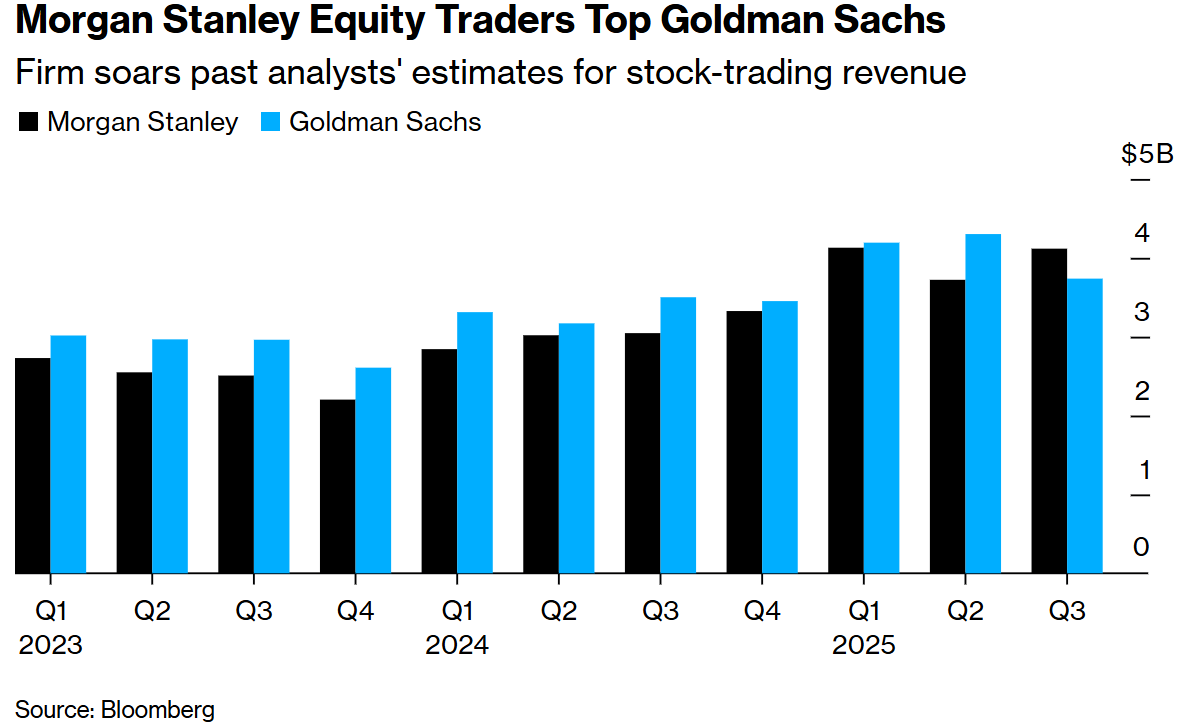

The stock market is a reflection of the broader economic environment and can offer insights into the health of the US economy. When companies report strong earnings and positive outlooks, it typically reflects well on the overall economy. Conversely, a decline in stock prices may indicate economic challenges or market uncertainty.

One key indicator to watch is the S&P 500 index, which tracks the performance of 500 large companies listed on stock exchanges in the United States. This index serves as a barometer for the broader market and can provide insights into the economic landscape.

Real Estate: A Pillar of Economic Activity

Real estate is a critical component of the US economy and often serves as a bellwether for economic health. Real estate includes residential, commercial, and industrial properties and plays a vital role in the economic cycle.

During periods of economic growth, real estate tends to thrive as demand for housing and commercial space increases. Conversely, during economic downturns, real estate markets can face challenges due to reduced demand and rising vacancy rates.

One important factor to consider in the real estate market is the housing market, which is a significant driver of economic activity. When the housing market is strong, it can lead to increased consumer spending and job creation.

Case Study: The 2008 Financial Crisis

The 2008 financial crisis serves as a prime example of how the US economy, stocks, and real estate are interconnected. The crisis began with the collapse of the housing market, leading to widespread mortgage defaults and financial turmoil. This, in turn, had a devastating impact on the stock market and the broader economy.

The crisis highlighted the need for stricter regulations and better risk management practices in the financial industry. It also underscored the importance of diversifying investments to mitigate the risks associated with any one sector.

Conclusion: Navigating the Intersection

Understanding the intersection of the US economy, stocks, and real estate is essential for investors and analysts alike. By closely monitoring these sectors and staying informed about the economic landscape, individuals can make more informed investment decisions and navigate the complexities of the market.

As the US economy continues to evolve, the relationship between stocks and real estate will remain a crucial area of focus. By staying informed and adapting to changing market conditions, investors can find opportunities for growth and success in these dynamic sectors.