The rise of e-commerce has transformed the retail landscape, and one of the companies at the forefront of this revolution is Ocado. With its impressive growth trajectory and innovative approach to online grocery shopping, Ocado has become a major player in the U.S. stock market. In this article, we delve into the latest insights and analysis of Ocado's U.S. stock performance, highlighting key factors that have contributed to its success.

Ocado's Background

Based in the United Kingdom, Ocado has been a pioneer in the online grocery industry since its inception in 2000. The company has successfully leveraged its cutting-edge technology and logistics infrastructure to offer customers a seamless shopping experience. Over the years, Ocado has expanded its operations globally, including its entry into the U.S. market.

Ocado's U.S. Stock Performance

Since Ocado's U.S. stock (OCDO) went public, it has attracted significant attention from investors. The stock has seen a steady rise in value, reflecting the company's strong performance and potential for further growth. Below, we discuss some key factors that have influenced Ocado's stock performance.

1. Strong Revenue Growth

One of the main reasons for Ocado's impressive stock performance is its robust revenue growth. The company has managed to consistently increase its sales year over year, driven by the growing demand for online grocery shopping. In its latest quarterly report, Ocado reported a 10.1% increase in revenue compared to the previous year, which underscores its ability to attract and retain customers.

2. Expansion into New Markets

Ocado has been actively expanding its presence in the U.S. market, with plans to open new fulfillment centers and expand its distribution network. This strategic expansion has helped the company tap into new customer segments and drive further growth. Investors are closely watching Ocado's progress in the U.S., as it could significantly impact the company's future revenue streams.

3. Innovative Technology

Ocado is renowned for its innovative technology, which has played a crucial role in its success. The company has developed its own proprietary software for order management, inventory management, and logistics optimization. This technology not only enhances the shopping experience for customers but also helps Ocado reduce costs and improve efficiency. As the e-commerce landscape continues to evolve, Ocado's technology advantage remains a key driver of its stock performance.

4. Strategic Partnerships

Ocado has formed several strategic partnerships that have bolstered its market position. One notable partnership is with Walmart, which has enabled Ocado to offer its online grocery services to Walmart customers. These partnerships help Ocado tap into new customer bases and expand its market reach, further contributing to its stock performance.

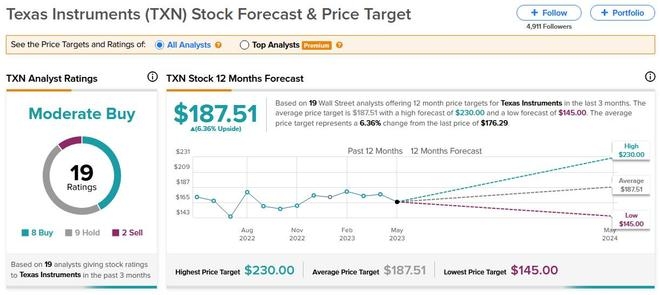

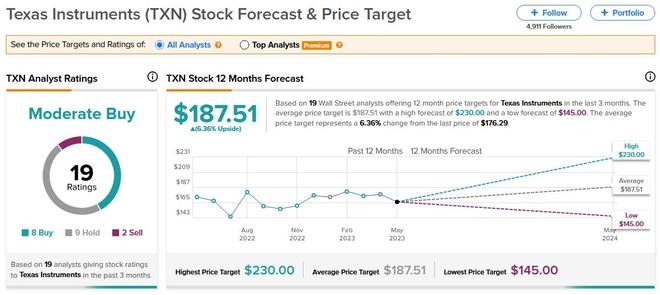

5. Analyst Ratings and Outlook

Analysts have remained optimistic about Ocado's future prospects, with many assigning buy or hold ratings to the stock. This positive outlook is driven by the company's strong revenue growth, strategic expansion, and innovative technology. However, it is essential for investors to conduct their due diligence and stay informed about the latest developments in Ocado's business to make well-informed investment decisions.

Conclusion

In summary, Ocado's U.S. stock has been a strong performer, driven by factors such as robust revenue growth, strategic expansion, innovative technology, and strategic partnerships. As the e-commerce industry continues to grow, Ocado remains a compelling investment opportunity for those looking to capitalize on the online grocery revolution. Investors should stay tuned to the latest developments and insights to make informed decisions regarding their investments in Ocado's U.S. stock.