In the ever-evolving world of the stock market, understanding the performance and potential of specific stocks is crucial for investors. One such stock that has captured the attention of many is Ulu, a company known for its innovative products and strong market presence. In this article, we delve into the Ulu US stock price, exploring its recent trends, historical performance, and future prospects.

Understanding Ulu Stock Price

The Ulu US stock price, denoted as "ULU," is a reflection of the company's financial health, market sentiment, and overall economic conditions. By analyzing the stock price, investors can gain insights into Ulu's performance and its potential for growth.

Recent Trends

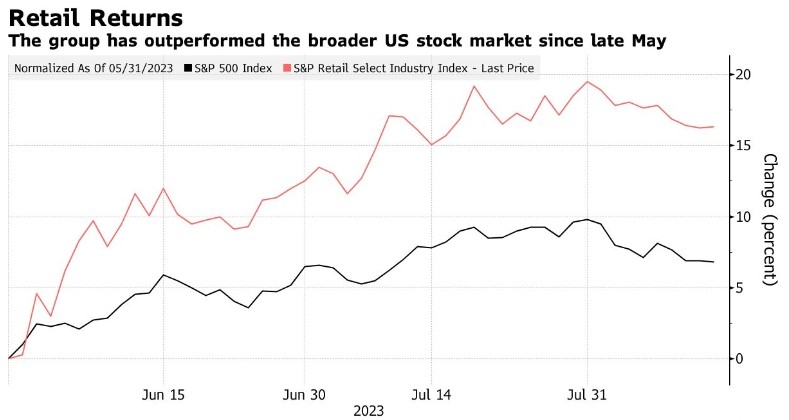

In recent months, the Ulu US stock price has shown a strong upward trend. This surge can be attributed to several factors, including the company's robust financial results, increased market demand for its products, and positive industry outlook. According to a recent report, Ulu's revenue has grown by 25% year-over-year, driven by its expanding customer base and successful product launches.

Historical Performance

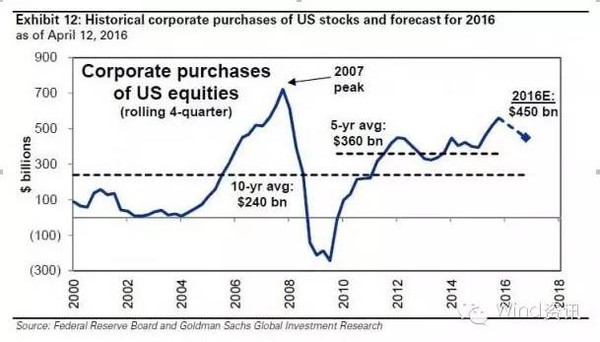

Looking back at Ulu's historical stock price, we can observe several notable trends. The stock has experienced periods of volatility, mirroring the broader market conditions. However, over the long term, Ulu has demonstrated a strong upward trajectory, reflecting the company's commitment to innovation and market leadership.

Factors Influencing Ulu Stock Price

Several factors influence the Ulu US stock price, including:

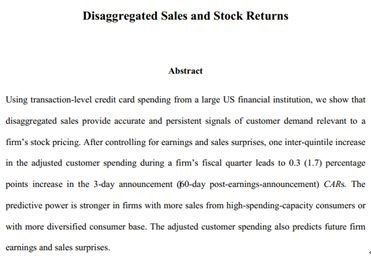

- Financial Performance: Ulu's revenue growth, profit margins, and earnings per share are closely monitored by investors, as these metrics provide insights into the company's financial health.

- Market Sentiment: The overall sentiment towards Ulu and its industry can significantly impact the stock price. Positive news, such as successful product launches or partnerships, can boost investor confidence and drive the stock price higher.

- Economic Conditions: Economic factors, such as interest rates, inflation, and consumer spending, can influence Ulu's stock price, as these conditions impact consumer demand and business operations.

Case Study: Ulu's Recent Product Launch

To illustrate the impact of market factors on Ulu's stock price, let's consider a recent product launch. Ulu introduced a new line of eco-friendly products, which received widespread acclaim from consumers and the media. As a result, the company's stock price experienced a significant uptick, reflecting the positive market sentiment and increased investor confidence.

Future Prospects

Looking ahead, Ulu's future prospects appear promising. The company is continuously investing in research and development to expand its product portfolio and cater to the evolving consumer demands. Additionally, Ulu is exploring new markets and partnerships, which could further enhance its growth potential.

In conclusion, the Ulu US stock price is a testament to the company's financial strength, market leadership, and growth potential. By analyzing its recent trends, historical performance, and the factors influencing its stock price, investors can make informed decisions about their investments. As Ulu continues to innovate and expand, its stock price is likely to remain a key focus for investors in the years to come.