The banking sector has long been a cornerstone of the US economy, with regional banks playing a vital role in supporting local businesses and communities. However, in recent years, these regional bank stocks have faced a tough time, often referred to as being "in the doghouse." This article delves into the reasons behind this trend and examines the outlook for these stocks.

Why Are Regional US Bank Stocks in the Doghouse?

Several factors have contributed to the struggling performance of regional US bank stocks. One of the primary reasons is the intense competition they face from larger, national banks. These national banks have greater resources and a broader customer base, making it challenging for regional banks to compete effectively.

Regulatory Challenges

Moreover, regional banks have been grappling with a series of regulatory challenges. The implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act has increased the compliance costs for banks, squeezing their profit margins. Additionally, the Federal Reserve's tight monetary policy has led to higher interest rates, making it more expensive for banks to borrow money.

Economic Factors

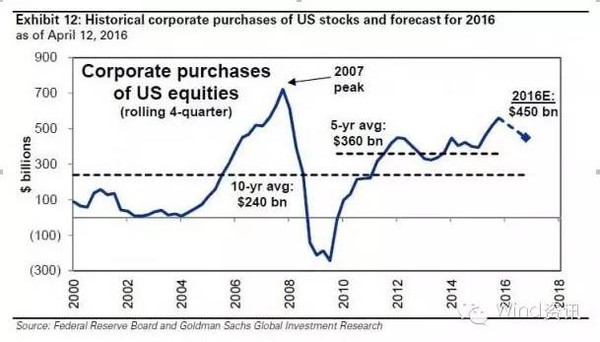

Economic factors have also played a significant role in the struggles of regional US bank stocks. The slow economic recovery in the aftermath of the 2008 financial crisis has reduced loan demand, while rising unemployment has increased the risk of defaults on loans.

Case Study: Bank of the Ozarks

A prime example of a regional bank struggling to overcome these challenges is Bank of the Ozarks (OZRK). The bank, based in Arkansas, has faced headwinds in recent years, including a decline in earnings and a decrease in its stock price. However, Bank of the Ozarks has taken steps to address these issues, such as expanding its digital banking capabilities and diversifying its revenue streams.

Outlook for Regional US Bank Stocks

Despite the challenges, the outlook for regional US bank stocks remains cautiously optimistic. The US economy is gradually improving, which should lead to increased loan demand and higher earnings for banks. Additionally, regulatory reforms and technological advancements could help regional banks become more efficient and competitive.

Conclusion

In conclusion, regional US bank stocks are currently in the doghouse due to intense competition, regulatory challenges, and economic factors. However, with the right strategies and a recovering economy, these banks have the potential to turn things around. As investors, it's crucial to closely monitor these trends and consider the long-term prospects of regional banks before making investment decisions.