The stock market has always been a rollercoaster ride of ups and downs. However, recent trends have sparked concerns about the possibility of a stock market bubble. In this commentary, we delve into the signs of a potential bubble, the potential consequences, and the measures investors can take to protect their portfolios.

Understanding the Stock Market Bubble

A stock market bubble occurs when the price of stocks becomes inflated beyond their intrinsic value. This typically happens due to excessive optimism, speculative trading, and a disregard for fundamental analysis. When the bubble bursts, it leads to a sharp decline in stock prices, often causing significant financial losses.

Signs of a Stock Market Bubble

Several indicators suggest that the US stock market may be approaching a bubble. Here are some key signs to watch out for:

- Overvalued Stocks: The Shiller P/E ratio, which compares the current price of a stock to its average earnings over the past 10 years, has reached record highs. This indicates that stocks are overvalued.

- Speculative Trading: The surge in trading volumes, particularly in highly speculative sectors like tech and biotech, indicates that investors are taking on excessive risk.

- Record Stock Buybacks: Companies are buying back their own shares at an unprecedented rate, which can drive up stock prices and mask underlying problems.

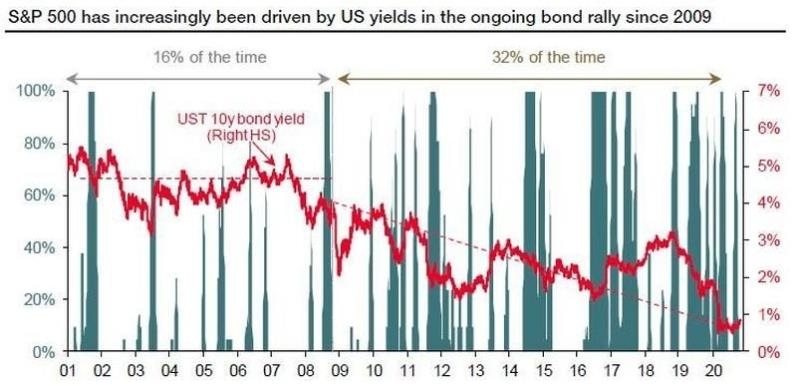

- Low Interest Rates: The Federal Reserve's low-interest-rate policy has encouraged investors to seek higher returns in the stock market, potentially leading to a bubble.

Potential Consequences of a Stock Market Bubble

A stock market bubble can have serious consequences for the economy and investors. Here are some of the potential outcomes:

- Market Crash: When the bubble bursts, it can lead to a sudden and severe drop in stock prices, causing widespread financial losses.

- Economic Recession: A stock market crash can trigger a recession, as businesses cut back on spending and consumers become more cautious with their finances.

- Increased Unemployment: A recession can lead to increased unemployment as businesses lay off workers to cut costs.

Protecting Your Portfolio

If you believe that the US stock market is approaching a bubble, there are several steps you can take to protect your portfolio:

- Diversify Your Investments: Diversifying your investments across different asset classes, sectors, and geographical regions can help reduce your exposure to market risks.

- Focus on Value Investing: Look for undervalued stocks with strong fundamentals, rather than chasing speculative trends.

- Maintain a Strong Emergency Fund: Having a well-funded emergency fund can help you avoid selling your investments at a loss during a market downturn.

- Stay Informed: Keep up-to-date with the latest market news and trends to make informed investment decisions.

Case Study: The Dot-Com Bubble

One of the most famous stock market bubbles was the dot-com bubble of the late 1990s. This bubble was driven by speculative trading in technology stocks, which became overvalued. When the bubble burst in 2000, the NASDAQ index plummeted by 78% in just two years. Investors who were heavily invested in tech stocks suffered significant losses.

In conclusion, the possibility of a stock market bubble in the US is a cause for concern. By understanding the signs of a bubble, taking appropriate precautions, and staying informed, investors can protect their portfolios and navigate the unpredictable stock market landscape.