In the dynamic world of financial markets, spread betting on US stocks has emerged as a popular investment strategy. This article aims to provide a comprehensive guide to spread betting on US stocks, covering its basics, advantages, and potential risks.

What is Spread Betting?

Spread betting is a form of betting where you speculate on the price movement of an asset without owning it. It is a leveraged product, which means you can control a larger amount of stock with a smaller amount of capital. In spread betting, you predict whether the price of a stock will rise or fall, and your profit or loss is calculated based on the difference between the opening and closing prices of your bet.

Advantages of Spread Betting on US Stocks

Leverage: Spread betting allows you to control a larger amount of stock with a smaller amount of capital. This can amplify your profits, but also increase your losses.

Tax-Free: Spread betting is tax-free in the UK, making it an attractive investment option for individuals looking to maximize their returns.

No Commission: Unlike traditional stock trading, spread betting does not incur any commission fees, which can help improve your overall returns.

24/7 Trading: US stocks can be traded 24/7, allowing you to take advantage of market movements at any time.

How to Start Spread Betting on US Stocks

Choose a Broker: The first step is to choose a reputable spread betting broker. Look for a broker that offers competitive spreads, low deposit requirements, and a user-friendly platform.

Open an Account: Once you have chosen a broker, you will need to open an account. This process typically involves filling out an application form and providing some personal details.

Deposit Funds: After your account is approved, you will need to deposit funds into your trading account. This can be done via credit/debit card, bank transfer, or other payment methods offered by your broker.

Place a Bet: Once your account is funded, you can start placing bets on US stocks. Decide whether you think the price will rise or fall, and place your bet accordingly.

Risks of Spread Betting on US Stocks

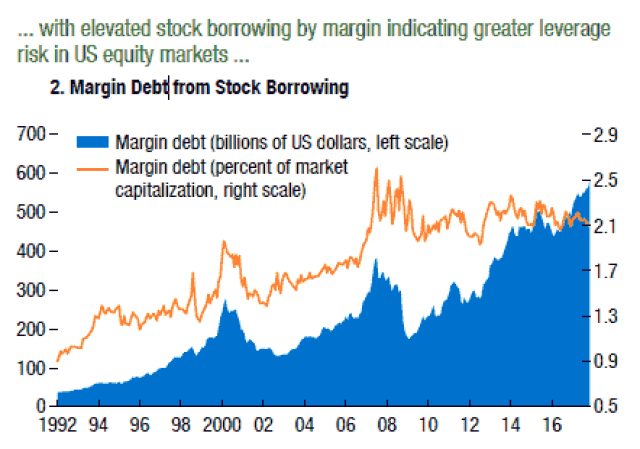

Leverage Risks: As mentioned earlier, leverage can amplify your profits, but it can also amplify your losses. Make sure you understand the risks associated with leverage before you start trading.

Market Volatility: The stock market can be highly volatile, and prices can change rapidly. This can lead to significant losses if you are not careful.

Lack of Ownership: When you spread bet on a stock, you do not own the stock. This means you miss out on dividends and other benefits associated with owning shares.

Case Study: Betting on Apple Inc.

Let's say you believe that the price of Apple Inc. will rise in the next few days. You decide to place a spread bet on Apple with a stake of

After a few days, the price of Apple reaches 155, and you close your bet. Your profit is calculated as follows:

Profit = (Closing Price - Opening Price) x Stake

Profit = (155 - 145) x

In this example, you successfully predicted the price movement of Apple Inc. and made a profit of $10,000.

Spread betting on US stocks can be a lucrative investment strategy, but it also comes with its own set of risks. Make sure you understand the basics and risks associated with spread betting before you start trading.