In the volatile world of stock markets, investors often turn to hedging strategies to protect their portfolios from potential downturns. However, during a market rout, these strategies can sometimes backfire, leading to unexpected losses. This article delves into the reasons behind this phenomenon and explores some key factors that can contribute to the failure of hedging strategies during turbulent times.

Understanding Stock Hedging Strategies

Hedging is a risk management technique used to offset potential losses in an investment portfolio. It involves taking positions in financial instruments that move in the opposite direction of the asset being hedged. Common hedging strategies include purchasing put options, selling call options, and using short positions.

Market Rout and Hedging Failures

A market rout is a severe and widespread decline in the stock market, often accompanied by panic selling and a general loss of confidence. During such periods, traditional hedging strategies can backfire for several reasons:

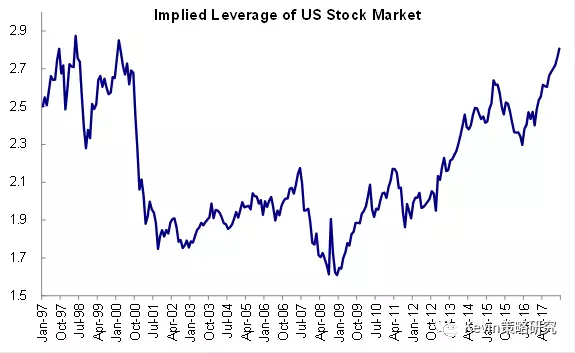

Incorrect Hedging Ratio: One of the most common mistakes investors make is not using the correct hedging ratio. This ratio determines the amount of protection an investor needs based on the volatility of the asset being hedged. A wrong ratio can lead to either under or over hedging, leaving the investor vulnerable to losses.

Hedging Costs: Hedging can be expensive, especially during a market rout when volatility is high. The cost of purchasing options or taking short positions can erode the investor's returns, leading to a net loss even if the hedged asset performs well.

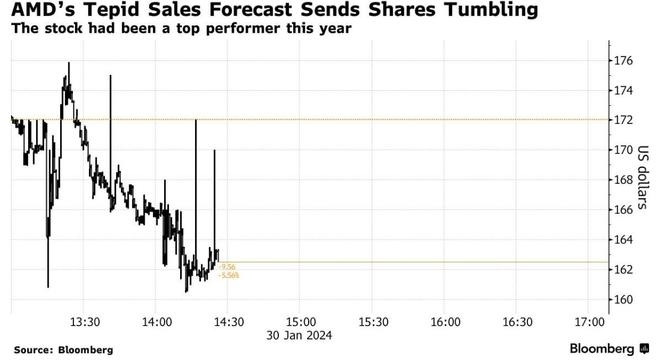

Market Sentiment: During a market rout, market sentiment can be extremely negative, leading to rapid declines in stock prices. This can cause hedging strategies to fail as the cost of protection increases, and the effectiveness of the hedge diminishes.

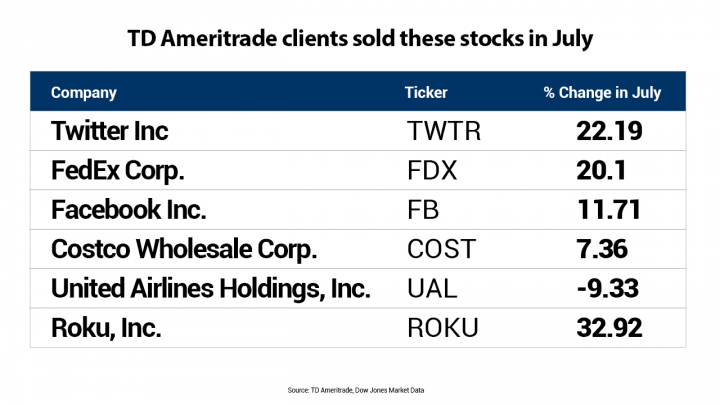

Liquidity Issues: In times of market stress, liquidity can become scarce, making it difficult to execute hedging strategies. This can lead to delays in executing trades, causing investors to miss opportunities or face higher transaction costs.

Case Studies

Several high-profile examples illustrate the potential pitfalls of hedging strategies during market routs:

Black Monday (1987): On October 19, 1987, the stock market experienced one of the most significant crashes in history. Many investors who had hedged their portfolios using put options found that the cost of protection skyrocketed, leading to significant losses.

Global Financial Crisis (2008): During the financial crisis, many investors relied on hedging strategies to protect their portfolios. However, the high cost of protection and the rapid decline in stock prices led to widespread losses, even for those who had hedged their positions.

Conclusion

While hedging strategies can be an effective way to protect portfolios during market downturns, they are not foolproof. Investors need to carefully consider the potential risks and ensure they are using the correct hedging ratios and strategies. During a market rout, the effectiveness of these strategies can be further compromised by factors such as high hedging costs, market sentiment, and liquidity issues. By understanding these risks, investors can better navigate turbulent markets and minimize potential losses.