Introduction: Are you looking to expand your investment portfolio and consider TFSA investment in US stocks? If so, you've come to the right place. A Tax-Free Savings Account (TFSA) is an excellent tool for growing your wealth without paying taxes on the earnings. In this article, we'll explore the benefits of investing in US stocks through a TFSA, the types of stocks to consider, and tips for maximizing your returns.

Understanding TFSA and its Advantages A Tax-Free Savings Account (TFSA) is a tax-advantaged account that allows you to grow your savings without paying taxes on the earnings. This means that the interest, dividends, and capital gains earned on your investments will be tax-free, giving you more money to reinvest or use for other financial goals.

One of the key advantages of a TFSA is the flexibility it offers. You can contribute any amount, up to your annual contribution limit, and withdraw it at any time without any penalties. This makes it an excellent vehicle for investing in US stocks, as you can take advantage of market opportunities without worrying about the tax implications.

Why Invest in US Stocks Through a TFSA? Investing in US stocks through a TFSA has several benefits:

Diversification: The US stock market is one of the largest and most diverse in the world, offering a wide range of investment opportunities. By investing in US stocks, you can diversify your portfolio and reduce your exposure to specific sectors or regions.

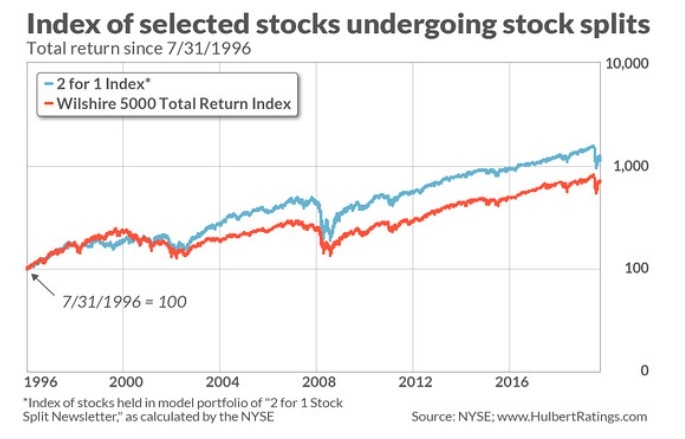

Potential for High Returns: The US stock market has historically offered higher returns than many other investment options. Investing in US stocks through a TFSA can help you maximize your earnings potential while enjoying tax-free growth.

Access to Blue-Chip Stocks: The US stock market is home to many of the world's largest and most successful companies, known as blue-chip stocks. These companies are often stable, profitable, and have a long history of growth. Investing in these stocks through a TFSA can provide you with a steady stream of income and potential capital gains.

Types of US Stocks to Consider When investing in US stocks through a TFSA, there are several types to consider:

Dividend Stocks: Dividend stocks pay investors regular dividends, providing a steady stream of income. These stocks are often found in the consumer goods, utilities, and healthcare sectors.

Growth Stocks: Growth stocks are companies with high potential for growth, often found in technology, biotech, and consumer discretionary sectors. While these stocks may not pay dividends, they can offer significant capital gains.

International Stocks: Investing in international stocks can provide additional diversification and potential for high returns. You can consider investing in US-listed foreign companies or international ETFs (Exchange-Traded Funds).

Tips for Maximizing Your Returns To maximize your returns when investing in US stocks through a TFSA, consider the following tips:

Research and Educate Yourself: Educate yourself on the market, sectors, and individual companies. Conduct thorough research to identify the best investment opportunities.

Diversify Your Portfolio: Diversify your investments across different sectors, industries, and geographical regions to reduce risk.

Rebalance Your Portfolio: Regularly rebalance your portfolio to maintain your desired asset allocation and risk tolerance.

Stay Disciplined: Avoid making impulsive decisions based on short-term market fluctuations. Stick to your investment strategy and maintain discipline.

Conclusion: Investing in US stocks through a Tax-Free Savings Account (TFSA) can be a smart financial move. By leveraging the tax advantages of a TFSA, you can maximize your earnings potential and enjoy tax-free growth. Remember to research, diversify, and stay disciplined to achieve the best results.